Comment of the Day @NeerajKA

can’t believe we memed a new global reserve currency into existence

— Neeraj K. Agrawal (@NeerajKA) February 21, 2018

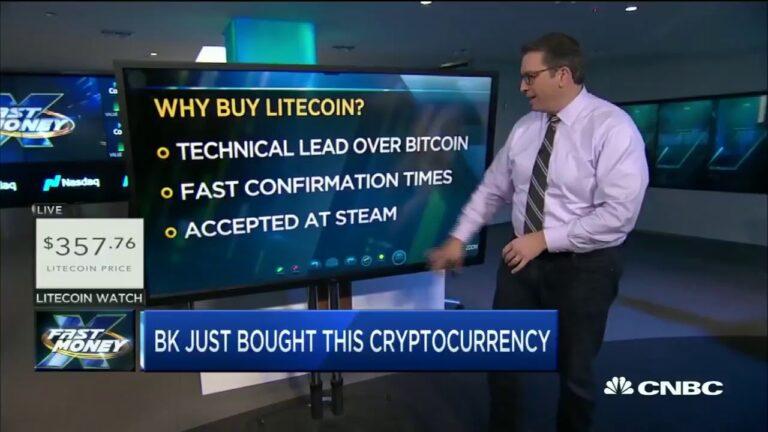

CNBC’s Fast Money Twitter account is dubious at the best of times and probably its best example of incompetence was pumping BCash just before taking Roger for a live interview and posting a chart of BCH trading on Coinbase at $8,500 saying its ‘Bitcoin Jesus’.

#BitcoinCash pic.twitter.com/LKthWUXJBQ

— CNBC's Fast Money (@CNBCFastMoney) December 20, 2017

Im sure you remember what happened to BCH after this tweet. If you can’t remember, trading was halted on Coinbase and the price has now plummeted to $1,500. Coinbase, CNBC and Roger Ver were all accused of market manipulation and insider trading. It later emerged that a BCash marketer was married to the social media account manager for CNBC Fast Money and had gained access to their Twitter which he was using to pump BCash. Thanks @whalepanda for that revelation! Oh, and one more point about CNBC’s Fast Money: they gave a tutorial on how to buy Ripple which suffered a 70% loss in value from that golden tweet…

Meet Paul Wasensteiner. Paul loves BCash. Paul is executive director for the Bitcoin Cash fund. Paul also probably loves Gaby Wasensteiner, but maybe not as much as he loves BCash. pic.twitter.com/Lv4aiAQSq3

— WhalePanda (@WhalePanda) December 20, 2017

In CNBCs defense, the more recent Twitter storm was actually started by Peter Brandt and ‘old school’ technical analyst who started covering the crypto space in 2016 on Twitter. His charting is popular and he now has over 160k followers. He accused CNBC’s Fast Money of cancelling an interview with him last minute because he was bearish on the bitcoin price in mid December.

.@PeterLBrandt this is FALSE. You have NEVER been scheduled to appear on Fast Money, nor has the show ever reached out. Moreover, on 12/14 we had the president of @coinbase on, and he did not offer a price target. But if this is what it takes to get twitter followers, good luck! https://t.co/okO2Arcds1

— CNBC's Fast Money (@CNBCFastMoney) February 20, 2018

This debacle was pretty quickly cleared up with an apology from Peter and the accompanying explanation that it was in fact @SquawkStreet that cancelled on him last minute.

My apologies to @CNBCFastMoney (my bad) but not to @CNBC It was actually @SquawkStreet that cancelled me at the last minute. See email from CNBC scheduling me for Dec 14. pic.twitter.com/BJ3MQZ1OkI

— Peter Brandt (@PeterLBrandt) February 20, 2018

@TuurDemeester quickly jumped to Peters defense:

“But if this is what it takes to get twitter followers, good luck!” What a low blow, you can do better. Peter has an excellent track record of integrity, as is again illustrated by his apology & attached evidence.

— Tuur Demeester (@TuurDemeester) February 21, 2018

It seemed as though this was all going to blow over, but a stranger story has emerged after Peter’s Twitter account was put under greater scrutiny from the episode. @Fullbeerbottle found that Peter constantly recycled tweets. There is nothing inherently wrong with this, but it is strange…

I like how @PeterLBrandt has a list of tweets that he cycles through every couple of months on repeat pic.twitter.com/ARAtJcgleU

— Emptybeerbottle (@Fullbeerbottle) February 20, 2018

More concerning, but sadly not very surprising, a crypto Twitter trader lies about his positions. @Guruleaks1 has a tweet feed from Peter’s account that show a long history of contradictory tweets where he changes his opinion and lies about his past exposure to crypto.

After making dozens of bullish/bearish comments on bitcoin, on December 4, 2017, @PeterLBrandt tells his followers he is “very long bitcoin” pic.twitter.com/HVWYyhHhQK

— GuruLeaks (@Guruleaks1) February 20, 2018

He is either deceiving followers to affect the market or is changing his story to make his trading decisions appear smarter. There must be a substantial pressure on Peter to consistently predict accurate market movements, considering his entire following depends on this.

TradingGuru @PeterLBrandt claims he's made 40% a year for 4 decades.

Here are some of his tweets on bitcoin. See if you can figure out his position:

Feb 25, 2017 @PeterLBrandt thought bitcoin “end was at hand” pic.twitter.com/7uD0zA4fK2

— GuruLeaks (@Guruleaks1) February 20, 2018

But why would Peter lie? The fact that his pinned tweet is a link to his paid trading group explains this… more followers = more money. Again, there is nothing inherently wrong with Peter selling trading advice, but you should consider it before taking his tweets as gospel.