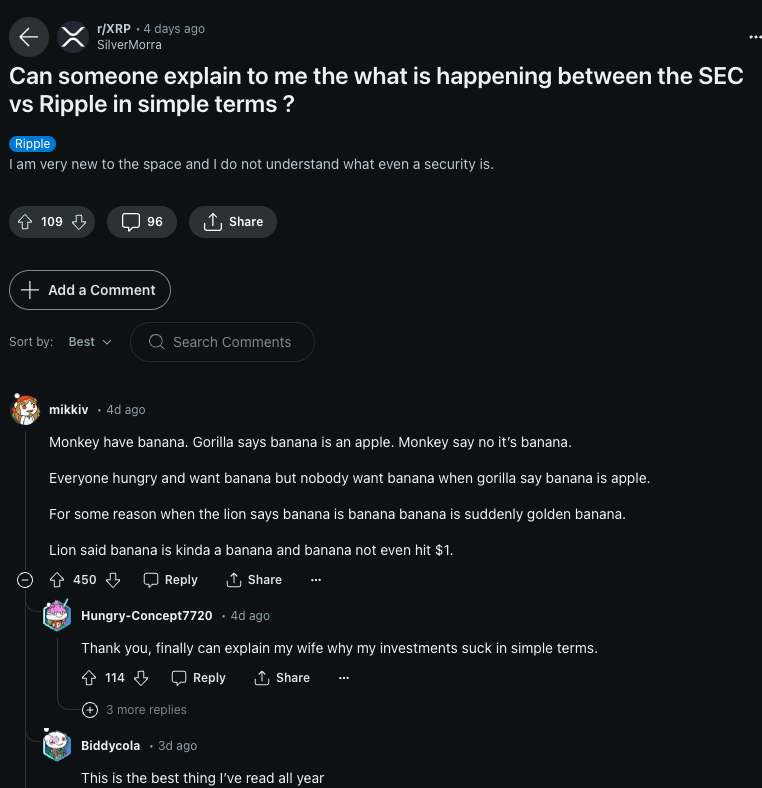

The ongoing legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) over the classification of the XRP token has captured widespread attention in the cryptocurrency community. To shed light on this complex issue, a user on the XRP subreddit ingeniously simplified the dispute using a memorable analogy, which has resonated with many for its clarity and humor.

In a Reddit discussion sparked by a user’s request for a simple explanation of the SEC v. Ripple case, another user provided a creative and illustrative metaphor:

“Monkey have banana. Gorilla says banana is an apple. Monkey say no it’s banana. Everyone hungry and want banana but nobody want banana when gorilla say banana is apple. For some reason when the lion says banana is banana banana is suddenly golden banana. Lion said banana is kinda a banana and banana not even hit $1.“

Here is an explanation of this metaphor:

- Ripple is portrayed as a Monkey, holding what it sees as a banana.

- The Banana represents XRP as a commodity, which Ripple maintains should not be regulated as a security.

- The SEC, depicted as a Gorilla, insists that the banana is actually an apple.

- The Apple symbolizes the SEC’s classification of XRP as a security, requiring oversight and regulation.

- The Lion, representing the U.S. court system, particularly Judge Analisa Torres, has the final say in determining the nature of XRP.

This metaphor not only highlights the essence of the legal arguments but also captures the conflicting perspectives in a way that’s easy to grasp for those unfamiliar with legal jargon.

The SEC initiated a lawsuit against Ripple in December 2020, alleging that Ripple conducted an unregistered securities offering by selling XRP. Ripple countered by arguing that XRP is a digital currency and should not be treated as a security.

On July 13, 2023, Judge Analisa Torres ruled that “XRP, as a digital token, is not in and of itself a ‘contract, transaction[,] or scheme’ that embodies the Howey requirements of an investment contract.” This ruling was a significant win for Ripple as it supported their argument that XRP is more akin to a commodity than a security.

This landmark decision has far-reaching implications for the cryptocurrency industry in the United States. It could influence how other cryptocurrencies are viewed and regulated by federal agencies, potentially fostering a more favorable environment for innovation and growth in the sector.

Currently, the SEC is seeking $2 billion in remedies from Ripple. In response, Ripple has contended that a sum no greater than $10 million would be appropriate. The SEC is expected to respond this week. It is anticipated that Judge Torres will make a ruling on the remedies sometime this summer.

Featured Image via Pixabay