Last week, the U.S. Securities and Exchange Commission (SEC) approved 11 spot Bitcoin exchange-traded funds (ETFs), which saw a combined volume of $4.37 billion. The ETFs, if history repeats itself, could help Bitcoin’s price skyrocket.

According to available market data, the price of Bitcoin first jumped to over $48,000 after rumors of a spot Bitcoin ETF approval started, but it quickly dropped back down after these were revealed to be false. When the SEC did officially approve the listing of these ETFs, the price had a sudden surge to near $49,000, but it has since dropped to $42,300 at the time of writing.

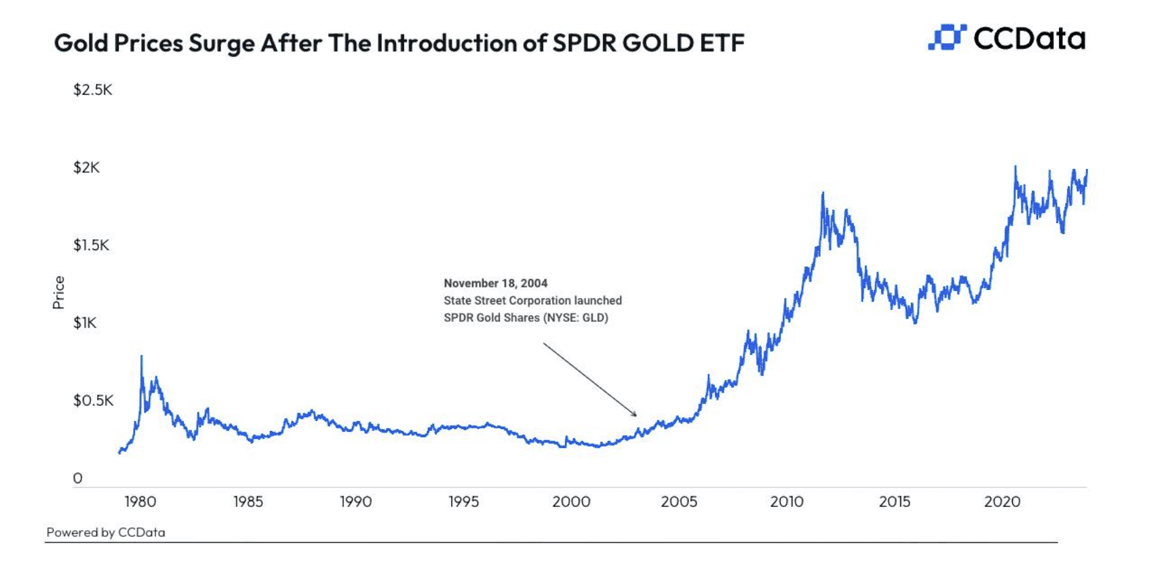

CCData’s latest Institutional Primer on the impact of a spot Bitcoin ETF compares it to the launch of the first gold ETF in the United States, which occurred back in November 2004 and per the report “provides insights into a potential Bitcoin ETF’s impact.”

The report details that gold’s price steadily rose from around $375 in May to $442 at the time of the ETF launch, reaching a high of $454 over substantial inflows. The precious metal’s price then retraced to $411 by early February 2005, the report adds, suggesting that we may observe a similar pattern for Bitcoin’s price as its price surged with the anticipation and saw a brief breakout, and could now see a healthy correction.

Nevertheless, by August 2011 the price of gold hit a record high as the SPDR Gold Shares (GLD) ETf became the world’s largest ETF, even surpassing the SPDR S&P 500 Trust ETF in value. As BTC competes with gold to become “the alternative asset class as the store of value,” the report concludes that “one can only wonder about the long-term growth potential for the Bitcoin asset class..”

The price of gold has since the launch of its first ETF skyrocketed to now trade at $2,050, an increase of over 445% over the last two decades. Bitcoin’s performance has been significantly better since it was first launched, but its market capitalization is still at $830 billion, compared to gold’s $13.7 trillion.

Featured image via Unsplash.