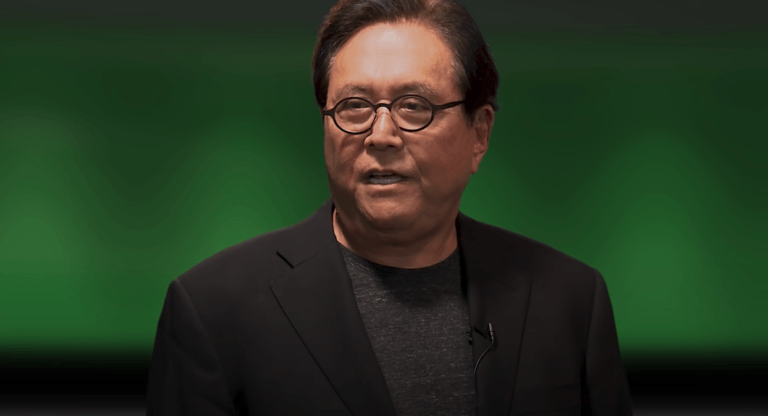

Yesterday (October 9), Robert Kiyosaki, the highly successful author of the “Rich Dad Poor Dad” series of personal finance books, shared his latest thoughts on gold, silver, and Bitcoin.

“Rich Dad Poor Dad“, which is one of the top 10 personal finance books of all time, “advocates the importance of financial literacy (financial education), financial independence and building wealth through investing in assets, real estate investing, starting and owning businesses, as well as increasing one’s financial intelligence (financial IQ) to improve one’s business and financial aptitude.”

At various times during the current COVID-19 pandemic, Kiyosaki has been criticizing the Federal Reserve’s response to the resulting economic fallout and strongly urging his large following on social media platforms to protect themselves from what he feels is inevitable high inflation (and possibly hyperinflation) in the future by using their fiat holdings to buy silver, gold, and Bitcoin.

Episode #263 of Anthony Pompliano’s “Pomp Podcast”, which was released on 7 April 2021, featured an interview with Kiyosaki. During that interview, Pompliano asked for Kiyosaki’s thoughts on “traditional inflation hedge” assets.

Kiyosaki said:

“Gold and silver are God’s money. Bitcoin is open source people’s money.“

On 25 April 2022, Kiyosaki published a tweet warning that the markets were heading for potentially the biggest economic depression in history.

Then, on 13 May 2022, he talked about crashes best times to get rich.

On October 2, it seemed like his stance on when to buy more Bitcoin had changed because unlike what he said on 13 May 2022 about buying more Bitcoin once he feels that it has found a bottom, he told his 2.1 million Twitter followers to use any interest rate hikes by the Federal Reserve (which is the central bank of the U.S.) as opportunities to buy more gold, silver, and Bitcoin (since he seems to believe that such rate hikes usually result in drops in the prices of these three commodities).

Furthermore, he said that once the Fed pivots and starts lowering interest rates again, people who follow his advice will be smiling because presumably he expects the prices for gold, silver, and Bitcoin to start going up again.

On October 7, Kiyosaki seemed even more bullish on Bitcoin, saying that although pension funds have always invested in gold and silver, they are “now investing in Bitcoin.”

Well, yesterday, the very successful author and investor advised his followers to protect themselves from the current macro environment by investing in gold, silver, and Bitcoin, and as usual Bitcoin perma-bear Peter Schiff was only able to agree about two of these three commodities being good inflation hedges.