On Thursday (April 22), crypto investor Adam Cochran explained why he believes that Solana could become “a top 3-5 project” and how it could even help Ethereum ($ETH) in the long run.

Here are the main highlights of his comments about Solana:

- “Where Ethereum focuses on maximizing decentralization, trustlessness and accessibility of the state machine, Solana aims at making slight trade-offs in these, and how state is stored, in order to optimize for raw processing power.“

- “Think of it like a computer, Ethereum is a CPU and Solana is a GPU. Both of them optimized towards different types of operations and states…“

- “If ETH is a 10 on the decentralized access scale, then SOL is a 7 or 8, simply because the cost of running a validator requires a much more robust system…“

- “Right now, Binance is training millions of new retail users on DeFi and wallets but will likely be unable to service them by the same time that SOL is just in an upswing.“

- “If Ethereum continues to be the prime access, interoperable settlement layer, then there is no better decentralized candidate to become the processing layer (replacing BSC) than $SOL. And, they are already booming with infrastructure to capture this.“

- “Plus, one thing it has that other chains didn’t (until Binance) was the support of a major exchange (FTX/Blockfolio). BSC grew because of ease of use migration tooling from Binance. The kind of thing other challenger protocols can’t replicate easily.“

- “So if $SOL continues to grow, and can catch the new BSC users to become a key processing chain, where does it end up? Even if it only captured a $60B mcap (meaning 30% less than Binance) it would weigh in at $152 per $SOL when fully diluted, or $226/$SOL at current dil.“

- “But, this assumes no market growth at all, which at current trajectories seems naïve. At a conservative growth rate of the market of even 15% over the next year, I think we could look at the $300 – $350 range in the new year assuming its able to capture that market.“

- “I think as this trend emerges, we’ll see defi protocols, governance infrastructure, corporate tooling, DAO coordination, and NFTs cement heavily into the ETH ecosystem as they focus more on the trade-offs ETH supports.“

- “Computationally intense B2C applications or backends will land on SOL. Since nearly all projects have elements of both, we’ll see projects expand across both ecosystems and the use of those products will add cross chain compounding value to both ecosystems.“

- “We’ll also see mobile applications integrate with $SOL and do infrastructure settlement on $ETH, since SOL is the only actually decentralized blockchain with settlement times cheap enough, fast enough, and with enough liquidity to support microtransactions at scale.“

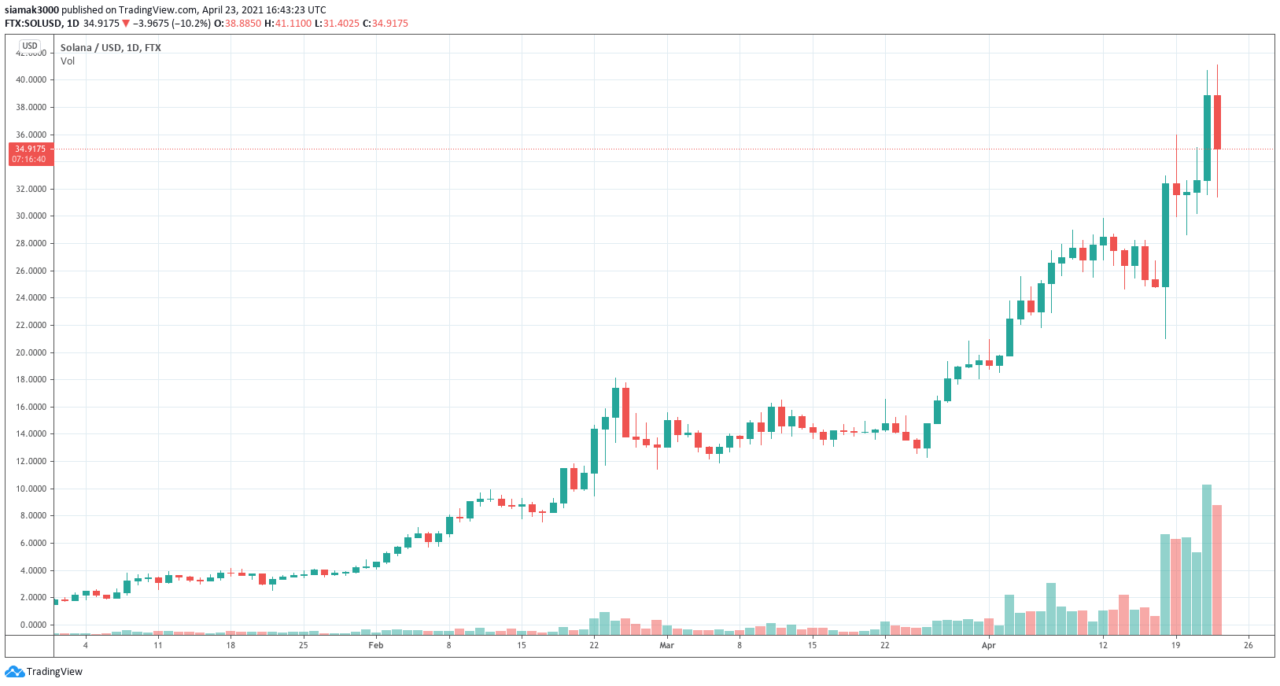

Data from TradingView indicates that currently (as of 16:45 UTC on April 23), trading around $34.93, which means that although it is down 11.07% (vs USD) in the past 24-hour period, in the year-to-date period, Solana is up 1,798.36% (vs USD).

And finally, if you want to learn more about Solana, then you may find the following article quite helpful: “Solana, The Goddess of light(speed transactions).“

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.