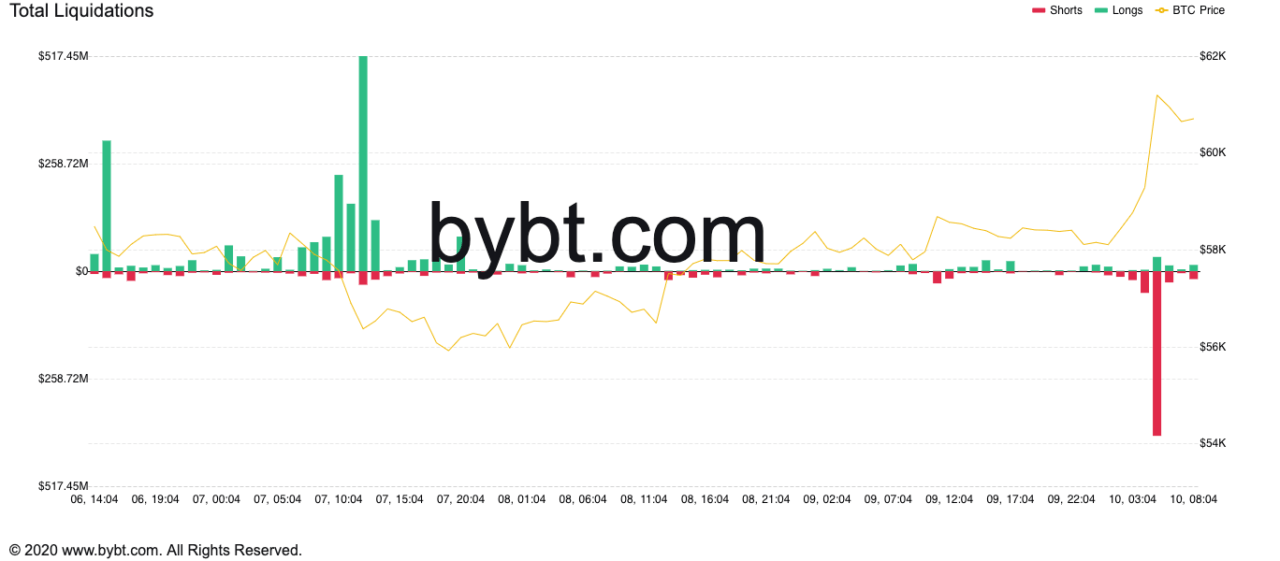

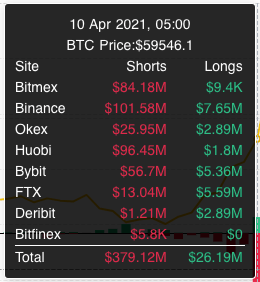

At 05:00 UTC on Saturday (April 10), the Bitcoin ($BTC) price broke above the $61,000 level for the first time in four weeks, in the process liquidating nearly $400 million worth of short BTC positions across major derivatives exchanges.

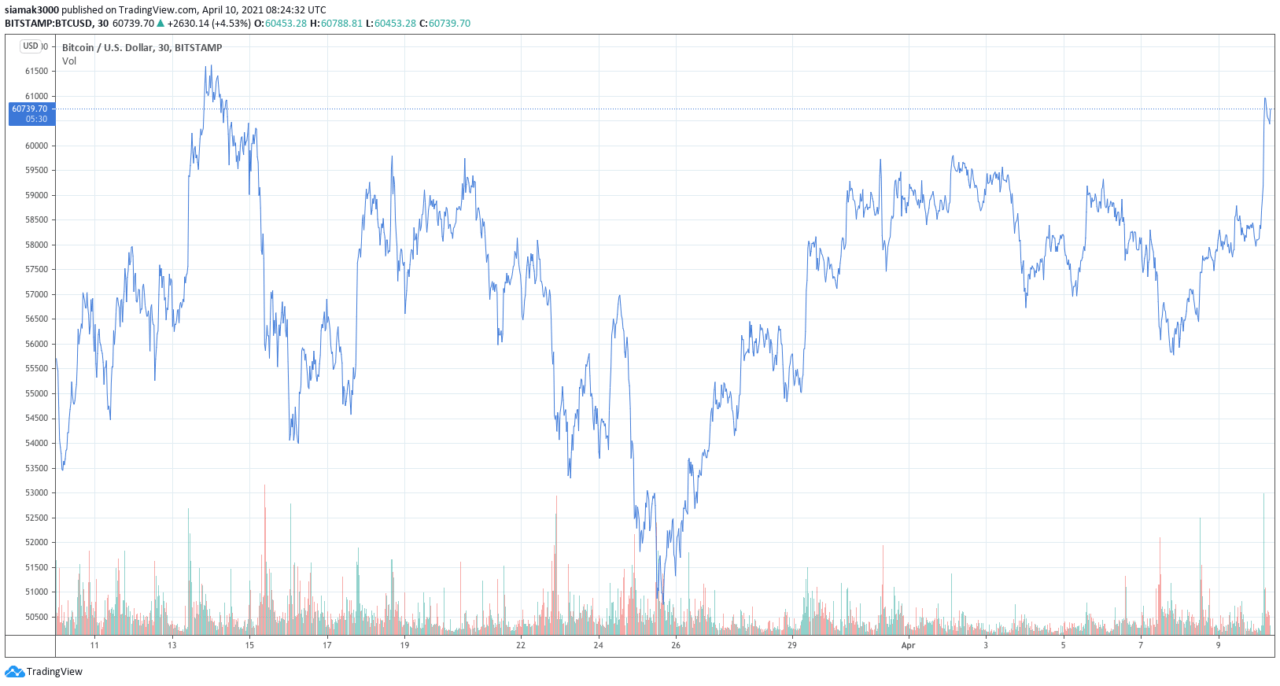

Data by TradingView indicates that around 05:00 UTC, on crypto exchange Bitstamp, the Bitcoin price went above $61K, and a minute later, reached $61,158, which is currently today’s intraday high. The last time Bitcoin was above $61K was on March 13, when it set the all-time high of $61,627.

According to Bybt, at 05:00 UTC on April 10, over $379 million in short BTC positions got liquidated across major crypto exchanges.

Here is how crypto analyst Alex Krüger summarized what happened to the BTC shorts: “Bitcoin shorts just got steamrolled by a wave of leveraged longs.”

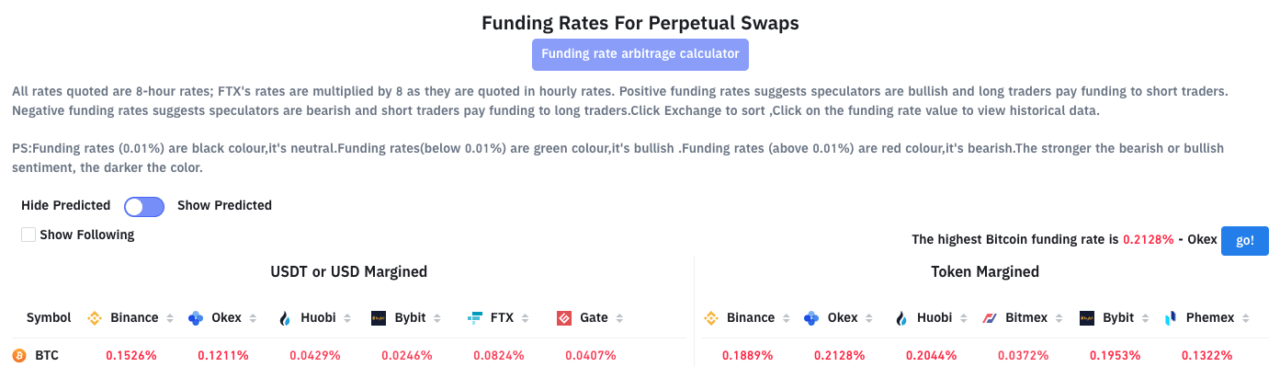

As of 08:40 UTC on April 10, funding rates for BTC perpetual swaps are positive. On Binance, the funding rate is 0.1889% and on OKEx it is 0.2128%.

Here is how Bybt says we should interpet these numbers:

“Positive funding rates suggests speculators are bullish and long traders pay funding to short traders. Negative funding rates suggests speculators are bearish and short traders pay funding to long traders.“

According to data by CryptoCompare, currently (as of 08:50 UTC on April 10), Bitcoin is trading around $60,534, up 4.78% in the past 24-hour period.

Featured Image by “vjkombajn” via Pixabay.com

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.