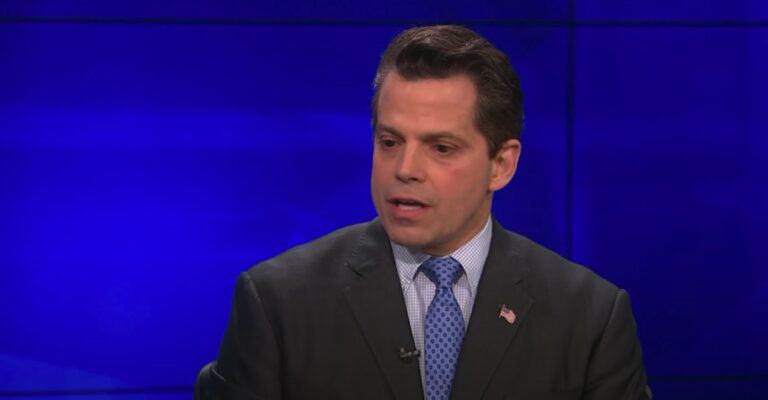

On Wednesday (February 17), former White House Director of Communications Anthony Scaramucci, the founder and managing partner of global alternative investment firm SkyBridge Capital, talked about Bitcoin’s growth story and why he believes that Bitcoin is superior to gold as a store of value.

SkyBridge is “a global alternative investments firm specializing in multi-strategy commingled fund of hedge funds products, custom separate account portfolios and hedge fund advisory solutions to address the needs of a wide range of market participants ranging from individual accredited investors to large institutions.”

On January 4, Skybridge announced “the launch of the SkyBridge Bitcoin Fund LP, which provides mass-affluent investors with an institutional-grade vehicle to gain exposure to Bitcoin.”

The press release went on to say:

“Additionally, on behalf of its flagship funds, SkyBridge initiated a position, valued at approximately $310 million at the time of this release, in funds investing in Bitcoin during November and December 2020.“

On February 10, Scaramucci was interviewed by Yahoo Finance correspondent Julia La Roche.

Here is what he said about Bitcoin:

“I started out as a Bitcoin skeptic. I want to confess to everybody that I’m not a Bitcoin evangelist, but I’m a Bitcoin investor. I’ve looked at the landscape, and I recognize that there is a spot now for Bitcoin and I’m trying to encourage my colleagues, I’m trying to encourage investors that have been with SkyBridge for many many years to think about it that way.

“And what I would say to money managers that are listening, you’re going to be benchmarked off of Bitcoin, meaning in your mosaic of stocks and bonds and alternatives and gold, they’ll be a few percentage points related to digital currency and since Bitcoin is the winner of that battle, it’ll likely be Bitcoin. And so if you’re not going to be an investor in Bitcoin, you’re effectively short Bitcoin for the purposes of that evaluation…

“Expect volatility. Invest in Bitcoin at the size and scale of money that you don’t need in the short term, but I do think it has a very big future…“

Then, on February 17, during an interview with Andrew Ross Sorkin on CNBC’s “Squawk Box”, Scaramucci said:

“The thing is volatile… I want to be cautious with individual investors, but we like it. We have over a half a billion dollars in Bitcoin right now, and obviously our Bitcoin fund started in December — it’s done quite well –but be cautious… I do think we see a hundred thousand dollars in this coin before year end. It’s just a supply-demand situation, and you don’t have a lot of supply out there and very heavy demand.“

Well, on March 18, the SkyBridge founder was back on CNBC’s Squawk Box, and was asked by Sorkin what would happen to the price of Bitcoin once its price more or less stablizes and the people who bought it as a speculative play decide to look for some other high-flying asset that would give them outsized returns.

Scaramucci replied:

“You’re in that transitory period. This is sort of like where Amazon was in 2000. People couldn’t believe its price movement. Then we looked at it again in 2009. There was a very big move over 12 years. Bitcoin is 12 years old. Yet if you bought Amazon after the 12th year, Andrew, you got a 64X return on your money from 2009 to 2021… If you bought Amazon on the public offering May 15, 1997, the $10,000 that you put into it is worth $21,140,000 today, but Amazon now, 20 years later, is trading with more stability.

“I mean, it got a very big pop because of the pandemic, but just take a look at this long-term chart, and I think that will happen to Bitcoin. Once it fully scales… you’re gonna be looking at that situation saying okay, ‘it’s way less speculative’.

“One last point. Bitcoin got to a trillion dollars faster than all of those companies primarily because it’s decentralized and so now you’re taking all of that C-suite drama and all the politics associated with it away from it. It is a fully-scaling monetary network and Store of value, and it’s going to get there over the next 15 years.“

As for that other much more established store of value, gold, Squawk Box co-anchor Joe Kernen said that he believed that gold’ recent poor performance must be because some percentage of people are now “buying Bitcoin and not gold”.

Scaramucci then jumped in to say:

“That’s the vinyl record. The world is changing.“

He later added:

“If you really study it, Joe, it’s better than gold. It’s easier to store. You can move it around more quickly and that value and that trusted network is growing. It’s 110 million now; by 2025, it’ll be at a billion, and if we’re right and it adapts pursuant to Metcalfe’s Law, you want to own some Bitcoin, and be prudent. You don’t have to own a lot of it, but just own some of it.“

Around one hour after Scaramucci’s interview on CNBC, Anthony Pompliano (aka “Pomp”), a co-founder of crypto-focused asset management firm Morgan Creek Digital Assets, had this to say about gold and Bitcoin:

He then went on to say:

- “Additionally, many people believe the non-monetary value of gold is important. They forget to mention that gold jewelry demand peaked in 2013 and has been falling since. Non-monetary value dropping quickly among younger generations.“

- “Young people would rather have digital skins and other digital products to show off wealth and status than gold rings or necklaces. It is unlikely that either gold or bitcoin goes to zero, but the probability of it happening to gold is much higher IMO.“

- “Lastly, central banks have become net sellers of gold for the 1st time in nearly a decade. They used to be long only bids, but now they have been net sellers multiple times in recent months. The narrative is changing. Tailwind is gold goes down over the next decade. We’ll see 🙂“

- “Also, @lexpaval pointed out gold for tech sector is less than 8%. If jewelry demand is falling, central bank demand is falling, and so is investment demand, then we are likely already watching early signs of gold collapse. Will take years, but underway.“

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.