With so much good Ethereum news floating about these days and earlier today the ETH price breaking $1850 for the first in over two weeks, it is hard to blame ETH investors for feeling optimistic.

Ethereum Price Action

Data from TradingView tells us that, on crypto exchange Bitstamp, around 01:34 UTC, the Ethereum price went above the $1850 level for the first time since February 22 and by 03:33 UTC it had reached $1858.85, which is currently today’s intraday high.

Earlier today, crypto analyst Ali Martinex said that in the short term he doesn’t believe that Ethereum price will have any trouble getting to the $1930 level:

Over the long term, crypto investor Ryan Sean Adams, who is the Founder of Mythos Capital, the author of popular DeFi newsletter “Bankless”, and the co-host of the “Bankless” podcast, believes that he ETH price could reach $20,000:

Decreasing Ethereum Balances on Centralized Exchanges

Today, crypto analytics firm IntoTheBlock talked about its “Net Flows” indicator (“Inflow Volume – Outflow Volume”) for Ethereum is showing that yesterday (March 8) approximately 104.79K ETH left major centralized crypto exchanges, which is bullish since this lowers selling pressure on ETH.

Here is IntoTheBlock explaining how what this indicator means and how it affects price:

“The Net Flows indicator highlights trends of traders sending money in and out of exchanges. Recall that Net Flows are positive when more funds are entering than leaving exchanges. Therefore, we observe that positive Net Flows tend to coincide with periods following large increases in price (like LINK when it tripled between April and July) or confirmation of down-trends (as seen with LINK in late August).

“Conversely, Net Flows are negative when a greater volume is being withdrawn from exchanges. This could be seen as a sign of accumulation (LINK in early August) or addresses buying back following large declines (LINK in early September).“

Status of Ethereum Layer 2 Scaling Solution

Here is Ethereum Foundation describe what Ethereum Layer 2 (L2) scaling solutions are designed to do:

“Layer 2 is a collective term for solutions designed to help scale your application by handling transactions off the main Ethereum chain (layer 1). Transaction speed suffers when the network is busy which can make the user experience poor for certain types of dapps. And as the network gets busier, gas prices increase as transaction senders aim to outbid each other. This can make using Ethereum very expensive.“

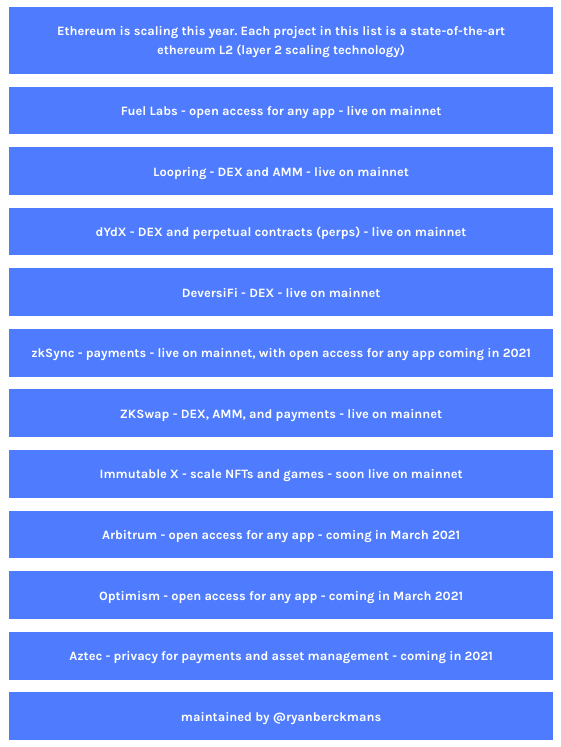

Ethereum consultant Ryan Berckmans maintains a very useful list that shows the status of various L2 scaling solutions:

Last Tuesday (March 2), one crypto analyst (“@0xRafi” on Twitter) explained via an excellent Twitter thread why the Ethereum community is so excited about the upcoming launch — later this month — of Optimism‘s L2 solution Optimistic Ethereum (which uses Optimistic Rollups):

- “The reason for all the excitement is that L2 solutions such as Optimism will help increase Ethereum’s throughput (tx per second), decrease latency (how long a tx takes to be confirmed) and greatly reduce gas fees. All without losing the security of the Ethereum mainnet.“

- “This is the main difference between ‘side-chain only’ solutions (such as @0xPolygon or @xdaichain) and actual Layer 2 solutions. Side-chain solutions have their own consensus mechanism and security, and do not benefit from ETH’s Layer 1 security, while L2 solutions do.“

- “While there are different existing L2 solutions, Optimism is a ‘generalised’ solution, meaning that any L1 Solidity smart contract (so any existing L1 app) can work on Optimism’s L2 without the need for any additional functionality to be built.“

- “The cool part is that once enough Ethereum apps are running on Optimism’s L2, most users will be able to stay on L2 for most of the time, without ever needing to come back to L1 except in case of dispute resolutions, or rare cases where a withdraw would be needed.“

- “And while you may think that this would render the Ethereum L1 useless, the reality is that it will more likely open the door for the Ethereum ecosystem to support new higher throughput applications that couldn’t even be dreamed of with the current network capacity.“

- “So what’s the status of Optimism adoption today? For starters, @synthetix_io is now running it on private mainnet, and once implementation is completed, Synthetix plans to fully transfer its staking and minting activities to L2, while keeping exchanges live in both L1 &L2“

- “@Uniswap ran a gamified proof of concept (Unipig) using Optimistic Rollups in Oct ’19, and will be first in line when Optimism mainnet goes live. @chainlink has also announced it will be implementing Optimism Rollups, @coinbase wallet added native support to Optimism testnet…“

- “@compoundfinance is also expected to implement Optimism (though not confirmed), and we know that @RariCapital is also well advanced in integrating Optimism to their platform. The list goes on, and the effects of the Ethereum network speed and costs will be game changing.“

Featured Image by “elifxlite” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.