Decentralized exchange SushiSwap has managed to gain ground on UniSwap as the top two decentralized exchanges leading the DeFi bull rally.

Despite getting off to a controversial start, involving creator Chef Nomi returning $14 million in funds to the community, SushiSwap has managed to gain ground on its competitor Uniswap. The platform has seen a boost in activity, including total value locked and the price of the governance token SUSHI.

A report by crypto analytics firm Delphi Digital evaluated the differences between the two platforms, concluding that SushiSwap has emerged as a significant competitor.

The report reads,

But if you’ve been keeping up with DeFi over the past couple of months, you know Uniswap’s moat is not intact as it stands today. Sushiswap, which started as a fork of Uniswap v2, has been catching up to Uniswap in terms of liquidity and volume across a range of pairs.

Delphi found that Uniswap’s first-mover advantage has provided the platform with a large number of integrating partners leveraging the service for liquidity., allowing the development team to focus on the release of v3.

SushiSwap instead has been focused on creating connections with other DeFi platforms such as Cream and Alpha, which has led to a similar increase in liquidity offerings.

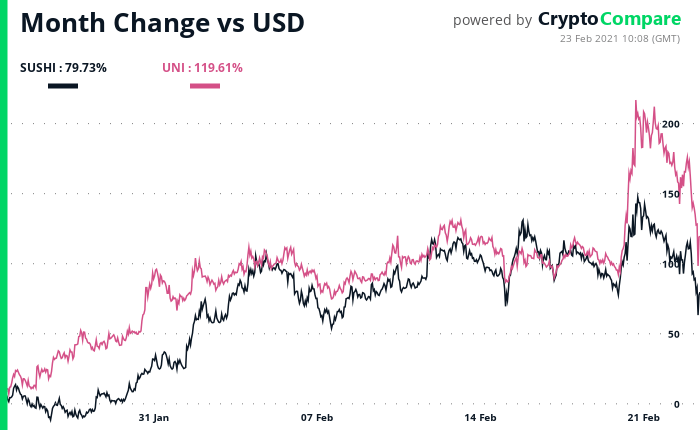

The price of Uniswap’s UNI token has moved up over 100% in the last 30 days, while SUSHI moved up nearly 80% in the same period, data shows.

Featured Image Credit: Photo via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.