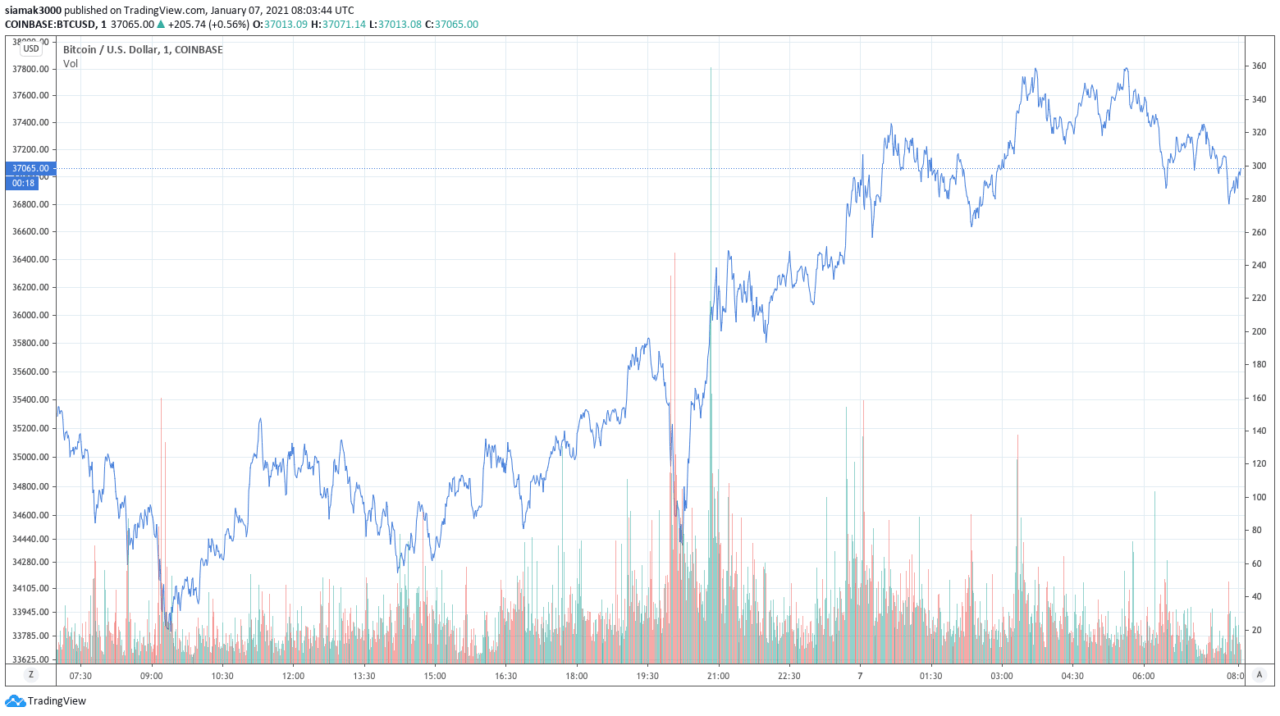

According to data from TradingView at 03:42 UTC on Thursday, on crypto exchange Coinbase, the Bitcoin price reached $37,808, setting once again a new all-time high (ATH).

This led Anthony Pompliano (aka “Pomp”), a co-founder of crypto-focused asset management firm Morgan Creek Digital Assets, to point out that Bitcoin’s market cap had just reached $700 billion.

According to data by CryptoCompare, as of 09:43 UTC on January 7, since the start of the year, the Bitcoin price has gone up 28.37% (against USD).

It is worth pointing out that today’s new all-time high above $37K comes just three days after a team of J.P. Morgan global market strategists led by Nikolaos Panigirtzoglou reportedly wrote in a note to clients that over the long term Bitcoin’s price could get to $146,000 and higher.

Prominent crypto analyst Alex Krüger said on Wednesday (January 6) that he expected to see the Bitcoin price reach $40,000 by the end of this week.

Later that day, Cameron Winklevoss, Co-Founder and President of crypto exchange Gemini, also said that he expected the Bitcoin price to reach $40,000 soon.

Santiago Roel Santos, a partner at crypto-focused investment firm ParaFi Capital, said that trading volumes at crypto exchange itBit (owned by Paxos), which is powering PayPal’s crypto trading service, are breaking all-time highs.

For those who are worried that Bitcoin’s insane price action looks unsustainable and that we might see a crash soon, crypto analyst Alex Krüger had this message: as institutional adoption increases, the sizes of any future Bitcoin price corrections should decrease.

On Tuesday (January 5), Charles Hayter, Co-Founder and CEO of cryptoassets market data provider CryptoCompare, said that “the growing corporate adoption and chronic lack of supply are the driving forces behind Bitcoin’s parabolic advance.”

And the increasing mainstream coverage of Bitcoin’s highly impressive price action, along with concerns that the Democrats’ control of both chambers of the U.S. Congress could lead to higher fiscal stimuli (which could lead to higher inflation), are making the case for Bitcoin as a digital store of value even stronger.

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.