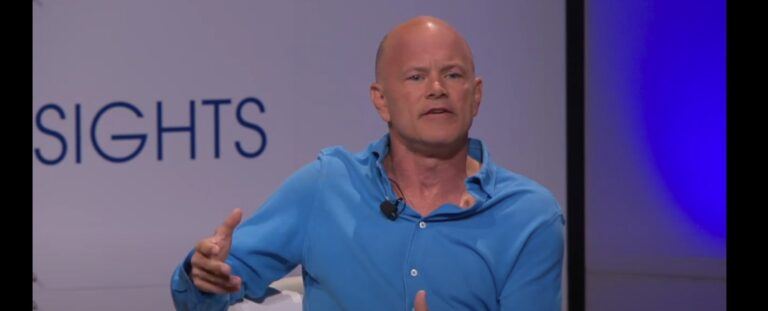

On Tuesday (December 1), billionaire investor Mike Novogratz shared his latest thoughts on Bitcoin and cryptocurrency in general. His comments came during an interview with Andrew Ross Sorkin on CNBC’s “Squawk Box“.

Former hedge fund manager Novogratz is the Founder and CEO of Galaxy Digital, “a diversified financial services and investment management innovator in the digital asset, cryptocurrency, and blockchain technology sector.”

Sorkin started by asking Novogrtaz if he agreed that money was being moved out of traditional assets like gold and into digital plays like Bitcoin and how meaningful this is.

Novogratz replied:

“It’s meaningful, but it’s not the real story. The real story is adoption of Bitcoin, adoption of crypto across a vast variety of accounts… it’s just a litany of institutional investors that are changing their mind or are realizing that now’s the time. There is enough liquidity for Bitcoin be part of it.”

Sorkin then pointed out to Novogratz that not all institutional investors are buying actual Bitcoin and that in fact it seems that they might mostly be buying it indirectly via shares of the Grayscale Bitcoin Trust (GBTC). (GBTC is available via traditional brokerages rather than crypto exchanges.)

Novogratz said:

“Yeah, listen, if Bitcoin was easy to buy, the price would have been a lot higher, and so Grayscale Trust was a very interesting way for people to get ETF-like exposure. It’s not an ETF, but it’s like an ETF… and so that’s the easier route.

“You’re seeing more and more now institutional pathways, but we have a fund. There are plenty of other funds that are geared towards institutions, and we’re seeing activity in those funds start to pick up as well…

“The big hedge funds are going to end up buying Bitcoin themselves, and they’re going to custody it… And so, you’re seeing the evolution of this industry, and it is speeding up in an accelerated fashion.”

Last month, during an interview with Alex Saunders in episode E734 of the “Nugget’s News” crypto podcast, Novogratz talked about how he first got into crypto, and how much he paid for one bitcoin back then:

“I got a call from a friend of mine. He asked me about Bitcoin, and I had never heard of it. He had moved out to the west coast — everyone was talking about Bitcoin — and so, I did 15 minutes of research, and was like ‘ah cool tech technology, libertarians like it’…

“This was in 2012. We’re in the European financial crisis. The Chinese were buying … so my first buys of Bitcoin were at about $95, and they were very speculative. I bought it because I thought it would go up.

“And as I started looking at it, digging in, I thought this could be cool. So, I called a friend of mine — Dan Moorhead from Pantera [Capital] — whom I had invested with when he ran a macro fund a few years earlier. I helped seed his macro fund…

“I said ‘Morehead, take a look at this; I don’t have enough time.’ And after two weeks, he called me back, and said ‘Dude, this is going to change the world’… So we decided — Pete Briger, my other partner, myself, and Dan — that we would buy a bunch of Bitcoin and to Dan’s credit he bought a lot. We were a lot richer than Dan at the time, and so he bought a lot of Bitcoin — about thirty thousand bitcoin — for himself, and so we’re like ‘I’ll have $30,001’ because we couldn’t let him have more than we had; so we roughly all about the same.”