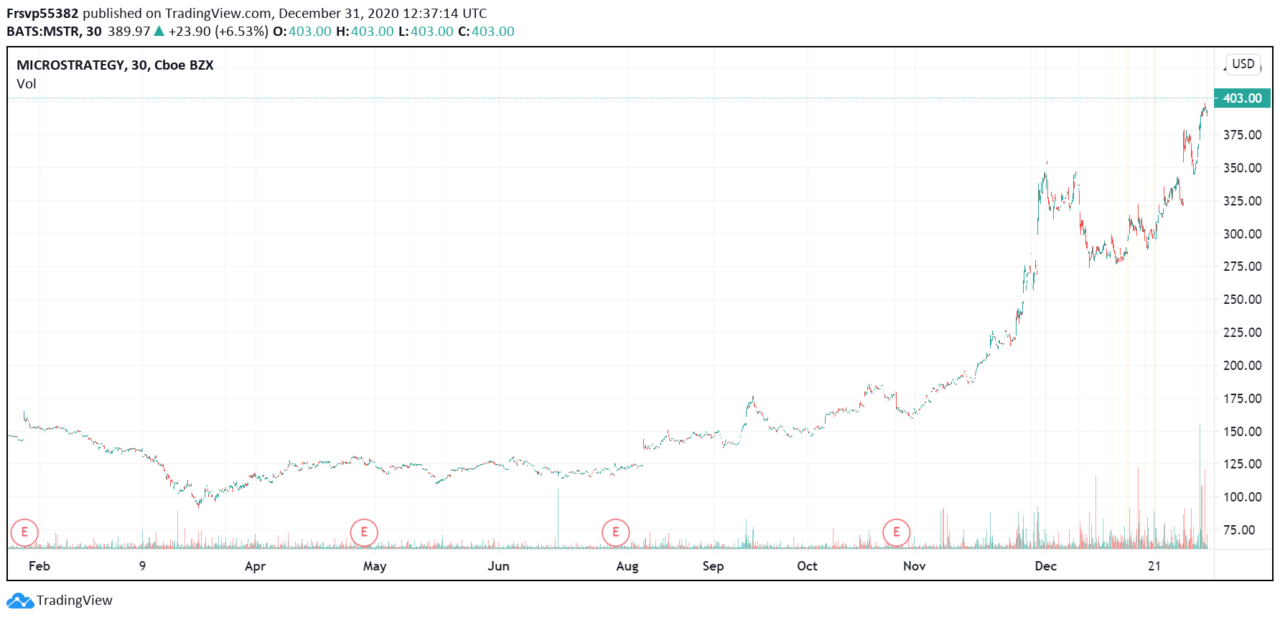

The stock price of business intelligence firm MicroStrategy (NASDAQ: MSTR) is up nearly 200% since the firm first started investing in bitcoin in August of this year. Part of the stock’s price rise has been attributed to its BTC investment.

Back in August, MicroStrategy made a massive $250 million bet on bitcoin as part of its capital allocation strategy. At the time the firm bought 21,454 BTC and detailed its decision to invest was influenced by “factors affecting the economic and business landscape,” which the firm believes are creating “long-term risks” for its corporate treasury program.

These factors include the economic and public health crisis created by the COVID-19 pandemic, the “unprecedented government financial stimulus measures including quantitative easing adopted around the world,” and global political and economic uncertainty.

MicroStrategy’s BTC investments did not stop there, however, as it then added more BTC to its wallets, purchasing “a total of 38,250 bitcoins at an aggregate purchase price of $425 million.” The business intelligence firm then raised $650 million via the offering of senior convertible notes due 2025 to invest in BTC.

All $650 million were used to buy bitcoin, and the firm now holds a total of 70,470 BTC bought at an aggregate price of $1.125 billion. The cryptocurrency it holds is now worth over $2 billion. Michael Saylor, the company’s CEO, has been a vocal BTC proponent since the investments started.

MicroStrategy has since redirected the Strategy.com domain to a page showing visitors the risk-adjusted returns of currencies, indexes, metals, stocks, and bonds compared to bitcoin. The cryptocurrency, it’s worth noting, is trading at new highs above $29,000.

On August 11, when MicroStrategy first announced it was investing in BTC, its stock price was close to $138 throughout the day. MicroStrategy is now trading above $400.

The stock’s gains have largely been attributed to the firm’s bitcoin investments. The Motley Fool wrote that its market capitalization has been rising “in line with the increased value on the balance sheet,” which implies “MicroStrategy stock’s move today appears completely rational.”

Featured image via Pixabay.