With Bitcoin’s current bull run taking the Bitcoin price above $16,000, it seemed like the right time to see what some of the most prominent crypto analysts, investors, and traders on Twitter are saying about this price rally.

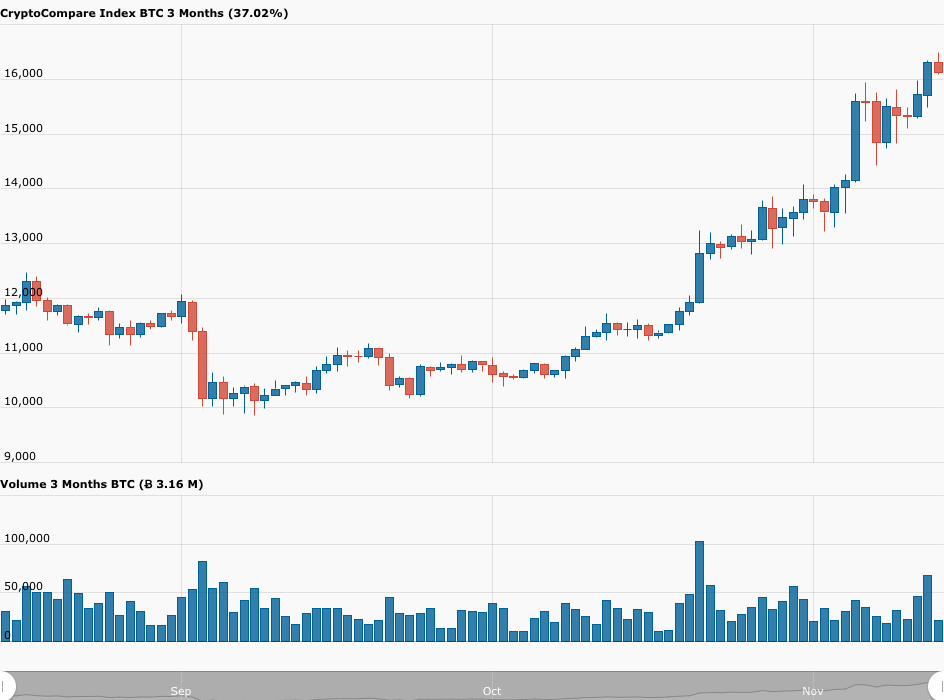

According to data from CryptoCompare, in the past five weeks, Bitcoin has had quite a bull run, with the price rising from a low of $10,541 on October 8 to a high of $16,482 earlier today (at 01:45 UTC on November 13), which means a gain of 56.36% vs USD.

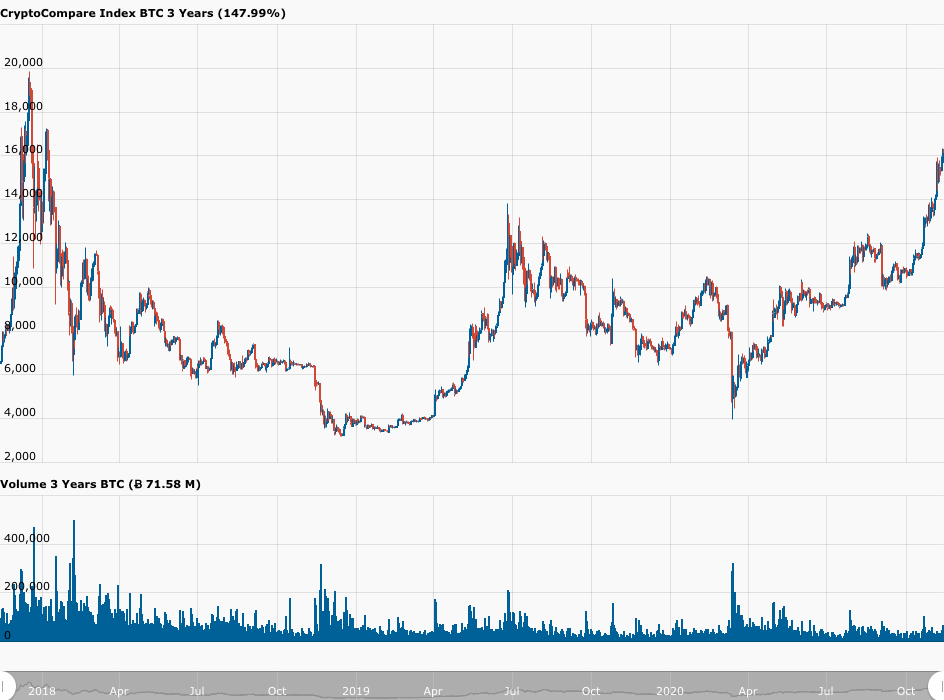

At 09:50 UTC on Thursday (November 12), Bitcoin finally broke through the $16,000 level for the first since 8 January 2018.

This event did not go unnoticed by CNBC, which covered it in yesterday’s episode of its post-market show “Fast Money”:

At the time of writing (11:35 UTC), Bitcoin is trading around $16,189, which means that the Bitcoin price is now just 22.73% from its all-time high (which was $19,870, and was reached on 17 December 2017).

Based on posts on social media, it seems that most Bitcoin HODLers are expecting the Bitcoin price to surpass its all-time high during the next couple of months (with many thinking it could happen before the end of this year).

But what are some of the most prominent crypto analysts, investors, and traders saying about Bitcoin’s current bull run?

Here are a few examples:

Yesterday, Simon Peters, a crypto analyst at eToro, the world’s leading social trading platform, had this to say about Bitcoin’s current price action in a note shared with CryptoGlobe:

“Bitcoin has touched $16,000 today, another major milestone in an already very impressive rally, and we may well see even higher prices before the year is out.

“Prices are moving in what’s technically considered an ‘upward continuation pattern’. More often than not, that means that prices will then break out of the pattern in the direction of the prevailing trend.

“If we see a strong bullish breakout from the pattern, then there is no reason we can’t see the next price threshold set at $17,500. That would take us to bitcoin’s previous resistance level from January 2018, when prices failed to push any higher after a major drop from the all-time high of $20,000.

“Now that the US election is behind us, attention is returning to the proposed fiscal stimulus package. Even with the prospect of a Covid-19 vaccine, the US economy will still need support to assist it through the period before it is made available to people. The size of the package and the mechanics behind its funding could be the catalyst to finally take us past $17,500.”

Finally, it is worth mentioning that yesterday PayPal said that its new crypto service, which was announced on October 21 and initially available to just 10% of its users, is now available to all eligible users in the United States:

PayPal is estimated to have over 346 million active users worldwide with over 40% of those estimated to be based in the U.S. This means that even if we just 1% of these US-based PayPal users try the new service, Bitcoin (which is one of the four cryptocurrencies supported) should receive a lot more mainstream attention in the next few/weeks, which should only help Bitcoin’s current price rally.

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.