U.S. stocks and cryptoassets fell on Tuesday (October 6) after President Donald Trump decided to pause negotiations with Democrats over the next major COVOD-19 fiscal stimulus package until after the U.S. presidential election.

Yesterday, the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite closed lower 375.88 points (1.34%), 47.68 (1.40%), and 177.88 (1.57%) respectively after President Trump tweeted (around 14:48 EDT or 18:48 UTC) that he wanted to pause the current stimulus talks until after the election — since he believes that the Democrats are not negotiating in good faith by asking for an unreasonably large fiscal stimulus (around $2.2 trillion) — and instead wanted the Senate Republicans to focus on getting the nomination of Judge Amy Coney Barrett to the U.S. Supreme Court confirmed as soon as possible:

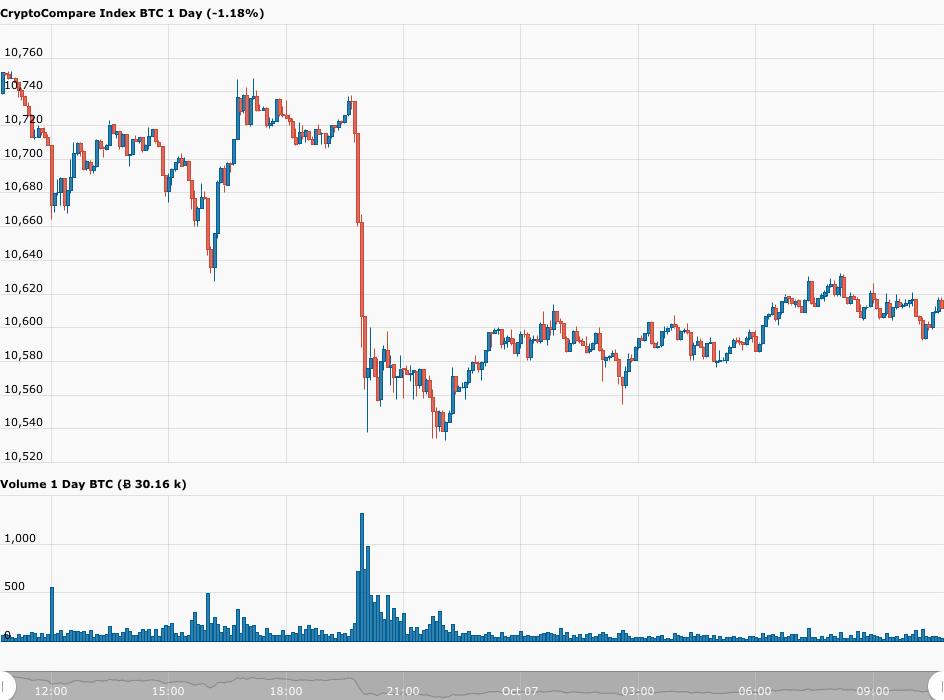

As for Bitcoin, which has mostly been trading like a risk-on asset during the COVID-19 pandemic, President’s Trump seemingly helped the price to fall from around $10,734 (just before the announcement) to around $10,563 (within 20 minutes of the announcement), as you can see in the 24-hour BTC-USD price chart below from CryptoCompare:

Seven hours later, the U.S. president decided to backtrack slightly, probably after realizing that he may have gone too far in his punishment of the Democrats (since no fiscal stimulus package before the presidential election could hurt him and the Republican party):

Then, less than 30 minutes later, President Trump sent out the following tweet:

William Albert Ackman, the founder and CEO of Pershing Square Capital Management, a hedge fund management company, sent out a tweet directed at President Trump and House Speaker Nancy Pelosi:

Yesterday, Federal Reserve Chair Jerome H. Powell, during his speech at the National Association for Business Economics Virtual Annual Meeting, stressed the need for further monetary and fiscal stimulus measures to help the U.S. economy:

“While the combined effects of fiscal and monetary policy have aided the solid recovery of the labor market so far, there is still a long way to go. Payrolls have now recovered roughly half of the 22 million decline. After rising to 14.7 percent in April, the unemployment rate is back to 7.9 percent, clearly a significant and rapid rebound. A broader measure that better captures current labor market conditions—by adjusting for mistaken characterizations of job status, and for the decline in labor force participation since February—is running around 11 percent…

“At this early stage, I would argue that the risks of policy intervention are still asymmetric. Too little support would lead to a weak recovery, creating unnecessary hardship for households and businesses. Over time, household insolvencies and business bankruptcies would rise, harming the productive capacity of the economy, and holding back wage growth. By contrast, the risks of overdoing it seem, for now, to be smaller. Even if policy actions ultimately prove to be greater than needed, they will not go to waste. The recovery will be stronger and move faster if monetary policy and fiscal policy continue to work side by side to provide support to the economy until it is clearly out of the woods.”

Anyway, Investor sentiment seems to have improved today since it appears that President Trump is willing to make some kind of deal with the Democrats.

In pre-market trading, currently (as of 05:53 EDT on October 7) futures on the Dow, the S&P 500, and the Nasdaq 100 are up 0.58%, 0.52%, and 0.52% respectively, which means that if this more cheerful mood continues, Bitcoin and other cryptoassets could bounce back later today.

Featured Image by “WorldSpectrum” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.