The market capitalization of the cryptocurrency-backed stablecoin DAI is closing in on the $1 billion mark, thanks to the growth of the decentralized finance (DeFi) space and the yield farming trend within it.

According to Messari, the supply of the DAI stablecoin grew by 623% in the third quarter of this year. The stablecoin started July with a market cap of $130 million, but since then it has expanded to surpass $940 million.

The stablecoin was initially only created by ether holders, who deposited ETH into the MakerDAO protocol as collateral to create the stablecoin. The introduction of multi-collateral DAI saw the introduction of other cryptoassets as potential collateral. These include Wrapped Bitcoin, Brave’s Basic Attention token and the Centre Consortium’s USDC stablecoin.

DAI itself is an ERC-20 token that’s used in various applications, including most of those within the DeFi ecosystem. Yield farmers can use DAI to earn interest on decentralized lending platform, as well as their governance token for interacting with the platform.

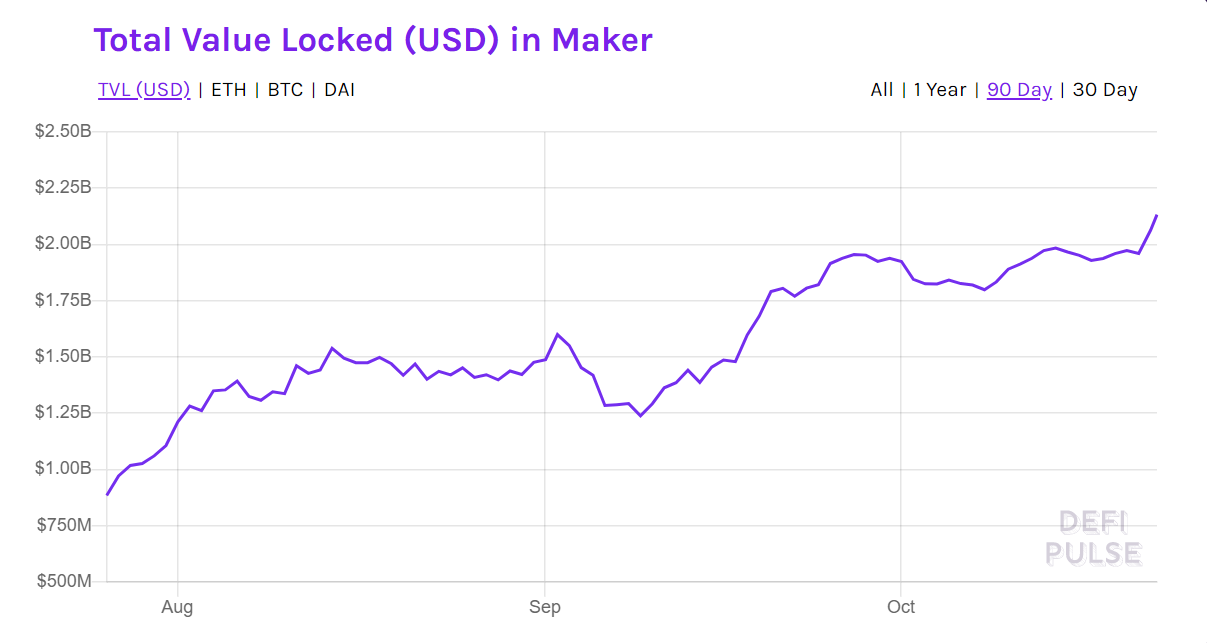

The increasing market cap of DAI comes as the total value locked on the MakerDAO protocol moved up from $880 million in late July to over $2.13 billion at press time.

Cointelegraph reports Messari attributes DAI’s growth to liquidity mining – yield farming – programs in DeFi. These included Compound’s COMP distribution, Yearn.Finance’s YFI, and Curve’s CRV distribution. The most recent protocol to launch a token bolstering DAI’s growth was Uniswap with its NI token.

The firm estimates that 65% of DAI’s circulating supply is moving within decentralized finance protocols to farm yield. Most of these tokens are based on the Ethereum blockchain, as few popular DeFi projects are outside of it.

The growth of DeFi did not just benefit DAI, but stablecoins as a whole. As CryptoGlobe reported, last month the total market cap of stablecoins in the crypto space surpassed $20 billion, with Tether’s USDT accounting for most of the funds.

Featured image via Pixabay.