On Thursday (October 8), FinTech firm Square disclosed that it had invested in Bitcoin.

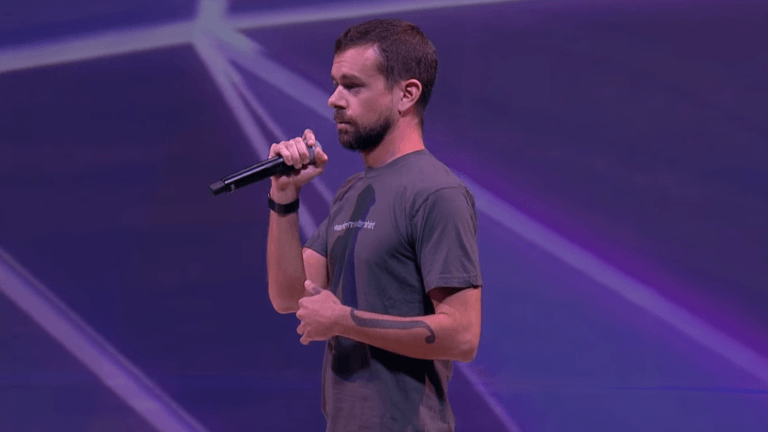

Square was founded in February 2009, i.e. it is 11 years old, just like Bitcoin (BTC). The three co-founders are Jack Dorsey (who is also the company’s Chairman and CEO), Jim McKelvey, and Tristan O’Tierney.

At 09:05 EDT (or 13:05 UTC) on October 8, the official account of Square’s Investor Relations team sent out the following tweet to disclose the company’s recent investment in Bitcoin:

According to Square’s press release, Square has “purchased approximately 4,709 bitcoins at an aggregate purchase price of $50 million,” and went on to say that Square “believes that cryptocurrency is an instrument of economic empowerment and provides a way for the world to participate in a global monetary system, which aligns with the company’s purpose.”

It also mentioned that this investment “represents approximately one percent of Square’s total assets as of the end of the second quarter of 2020.”

Square’s Chief Financial Officer, Amrita Ahuja, had this to say:

“We believe that bitcoin has the potential to be a more ubiquitous currency in the future.

“As it grows in adoption, we intend to learn and participate in a disciplined way. For a company that is building products based on a more inclusive future, this investment is a step on that journey.”

Square’s investment in Bitcoin, although very welcome news for Bitcoin investors (who have witnessed pretty boring price action during the past few weeks), is not too surprising for two reasons.

First, Jack Dorsey, the company’s Co-Founder and CEO, has long been a strong advocate for Bitcoin. For example, take a look at Dorsey’s Twitter profile:

Users of Square’s Cash App have been able to buy and sell Bitcoin since January 2018:

Second, Nasdaq-listed business intelligence company MicroStrategy Inc.’s made a very interesting announcement about Bitcoin back in August that must have influenced Square’s decision.

On August 11, MicroStrategy announced via a press release that it had “purchased 21,454 bitcoins at an aggregate purchase price of $250 million” to use as a “primary treasury reserve asset.”

Michael J. Saylor, CEO of MicroStrategy Inc., said at the time:

“This investment reflects our belief that Bitcoin, as the world’s most widely-adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash.

“Since its inception over a decade ago, Bitcoin has emerged as a significant addition to the global financial system, with characteristics that are useful to both individuals and institutions.

“MicroStrategy has recognized Bitcoin as a legitimate investment asset that can be superior to cash and accordingly has made Bitcoin the principal holding in its treasury reserve strategy.”

Then, on September 2015, Saylor disclosed that his company had made a second large purchase of Bitcoin:

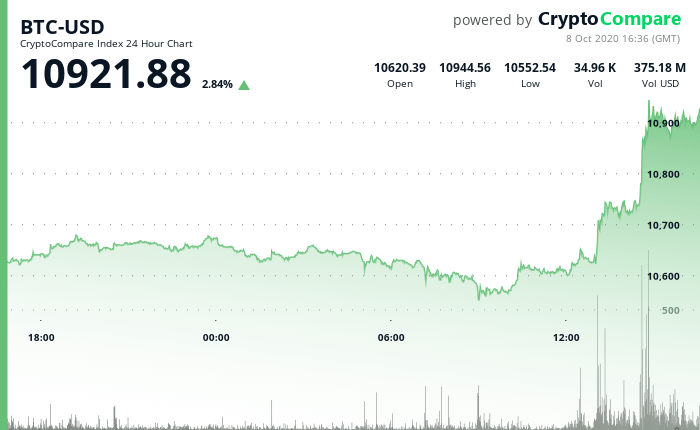

According to data from CryptoCompare, Bitcoin is currently (as of 16:36 UTC) trading around $10,921, up 3% since Square’s announcement.

Tyler Winklevoss, Co-Founder and CEO of digital asset exchange Gemini, had this to say about Square’s investment in Bitcoin: