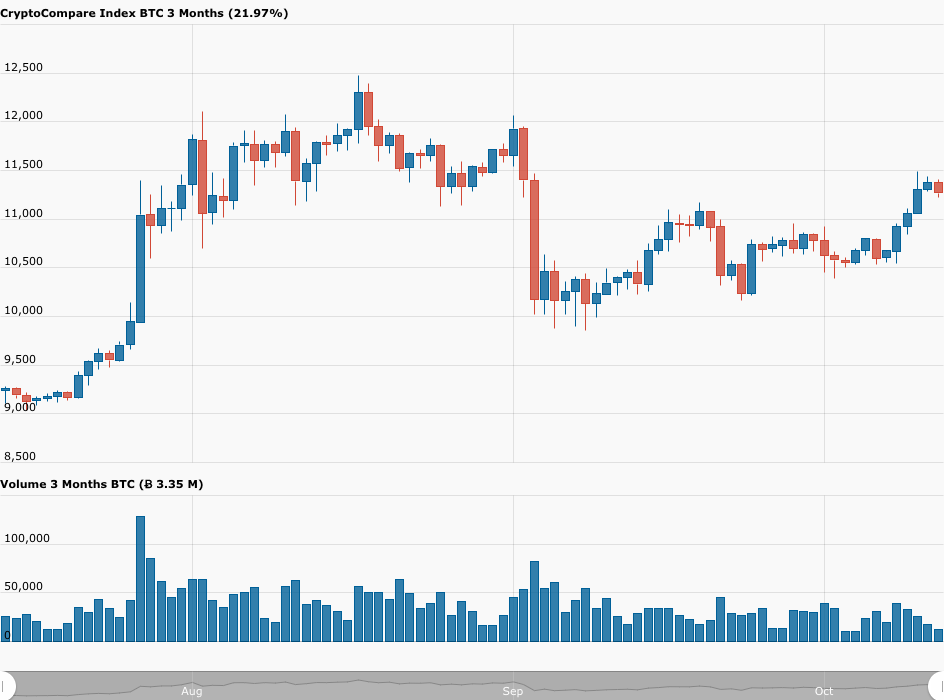

On Monday (October 12), Bitcoin’s surge towards the $12,000 level continues as talks go on between Washington lawmakers and the Trump Administration over the next COVID-19 fiscal stimulus package.

Since September 23, Bitcoin has had a nice run, going from a low of $10,166 to a high of $11,485 on Saturday (October 10), i.e. a surge of almost 13% vs USD in less than three weeks.

This price surge has been mostly powered by two things:

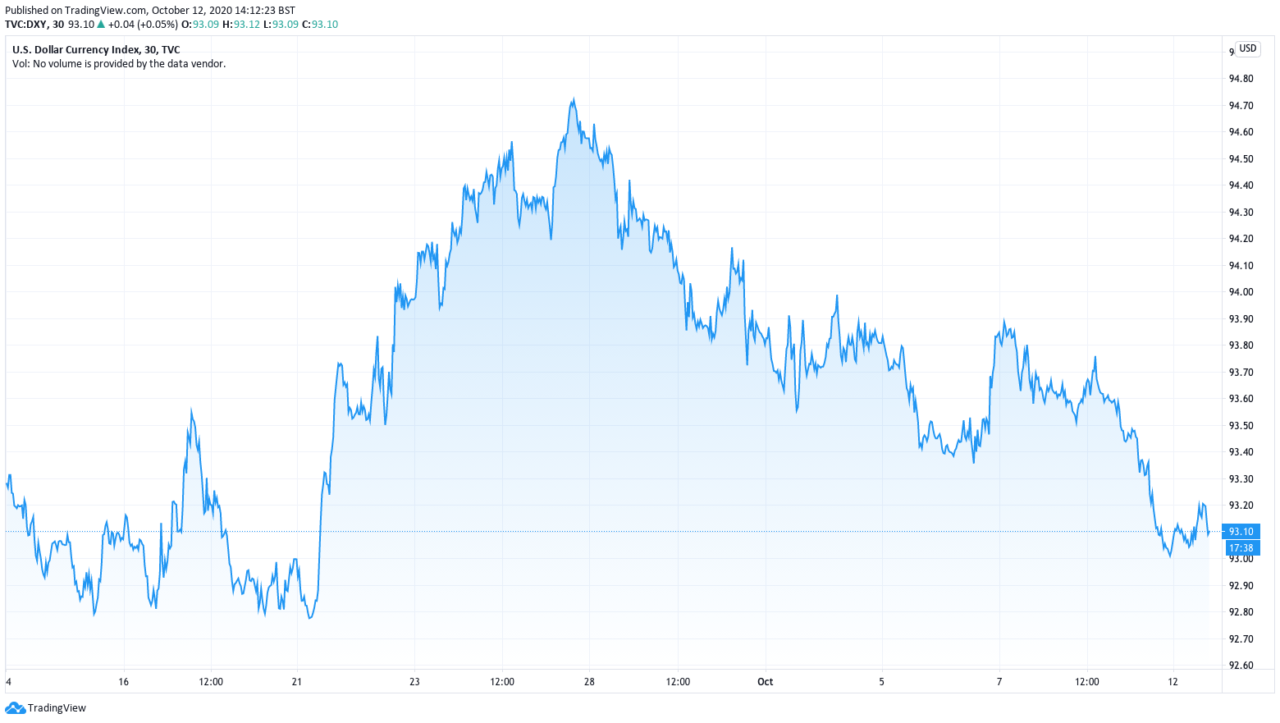

The Weakening of the U.S. Dollar

Since September 25, the U.S. dollar index (DXY) has dropped from 94.72 to 93.10 (where it is on October 12 at the time of writing).

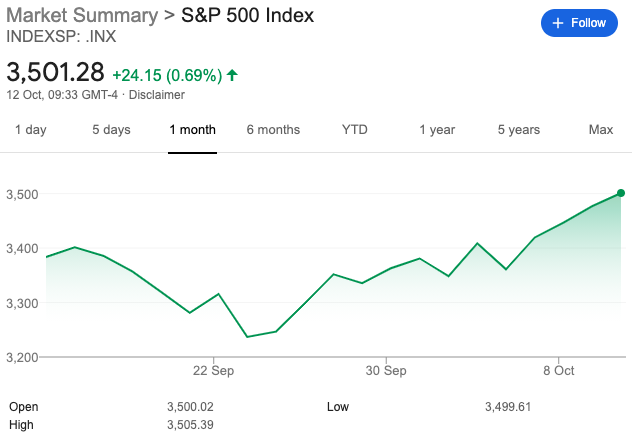

Optimism About a Major Stimulus Deal

During the past couple of months, we have gone from a $1 trillion COVID-19 relief proposal by the Senate Republicans on July 27 to a $1.8 trillion proposal by President Trump on October 9. Since this latest offer is only $400 billion less than the $2.2 trillion being asked by House Democrats and President Trump badly needs to secure a deal and have the bill get passed by the U.S. Congress before next month’s U.S. presidential election, it seems that every day we are inching closer to a deal.

This optimism has helped both U.S. stocks and Bitcoin to rally since September 23. Between September 23 and October 12, the Bitcoin price has gone from $10,166 to $11,490 (as of 09:55 EDT), which is a gain of 13.02% vs USD. During the same period, the S&P 500 has gone from 3236.92 to 3501.28 (as of 09:33 EDT), which is a gain of 8.12%.

The Week Ahead

A few minutes ago, despite the confusing the state of stimulus negotiations in Washington, the U.S. stock market opened; as of 09:40 EDT, the Dow, the S&P 500, and the Nasdaq Composite are all in green territory, up 0.43%, 0.85%, and 1.59% respectively.

Earlier today, FXStreet had this to say about the U.S. dollar index: “While below the 200-day SMA, today at 96.92, the negative view on the dollar is expected to prevail.”

With the U.S. presidential election just three weeks away, we should see further progress on the stimulus talks this week.

Tomorrow (October 13), Apple is expected to announce this year’s new iPhone models; this should give a nice boost to the tech sector, and help it to once again lead the rest of the U.S. stock market higher.

And since Bitcoin has been viewed as a risk-on asset since March, if the U.S. stock market goes up this week, with or without any further weakening in the U.S. dollar, it is likely that the Bitcoin price will also go up.

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.