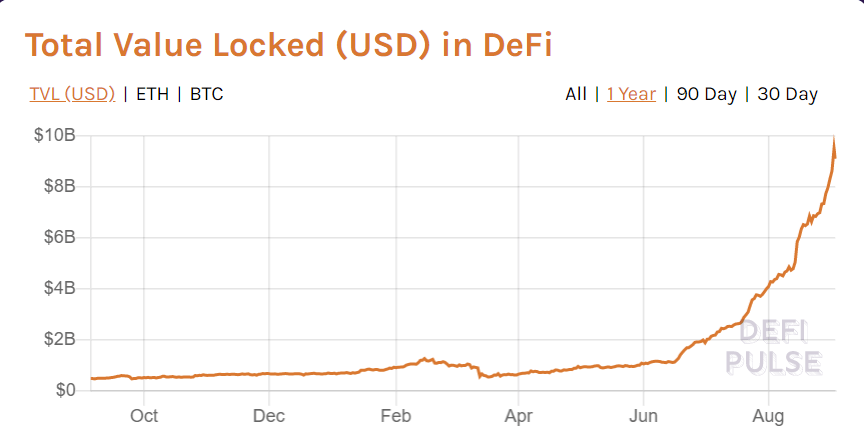

The total value of cryptocurrencies locked in the decentralized finance (DeFi) ecosystem has surpassed the $9 billion mark this week as centralized trading platforms are boosting token liquidity.

According to data from DeFi Pulse, one year ago there were less than $500 million licked in the space, and its growth was relatively slow up until June of this year, when DeFi lending protocol Compound started distributing its COMP governance token.

Since then a yield farming trend took off, with users lending and borrowing from protocols that issued their own governance tokens in a bi to maximize yields with the token rewards. The value locked in decentralized finance, similarly, started surging and is now above $9 billion.

The protocol with the most value locked in it is decentralized exchange Uniswap, with $1.59 billion, and is followed by DAI stablecoin issuer Maker, with $1.54 billion. Next to it is lending protocol Aave, with $1.49 billion, and it’s followed by decentralized exchange Curve Finance, with $1.08 billion.

Other top DeFi protocols, including yearn.finance, Synthetix, Balancer, and Compound all have well over $700 million worth of cryptoassets locked in them. As CryptoGlobe reported, these protocols helped the total value locked in DeFi hit $8 billion late last month.

Centralized cryptocurrency exchanges have also been aiding in the space’s growth by boosting its liquidity. While most cryptocurrency trading platforms have already added one or two DeFi governance tokens – with some adding in derivatives for these as well – popular exchange OKEx stands out for listing a total of 32 DeFi tokens so far.

The spot and derivatives exchange has been listing the tokens over time, and last month even added a total of eight DeFi tokens in a single day. In response to the listings, traders pumped the prices of some tokens, some of which have already seen corrections.

At the time of the listings OKEx CEO Jay Hao commented:

The decision to list eight new DeFi tokens today is far from the end of OKEx’s support for DeFi projects. We are committed to continuously helping the development of DeFi and further promoting the blockchain industry.

To help traders quickly find information about these tokens, OKEx launched a “DeFi category” on its website, which further reflects “OKEx’s dedication to the space.” The token listings, OKEx said, reinforce its commitment to the potential of the decentralized finance economy.

As reported, OKEx was the first centralized exchange to list Curve’s CRV token, and boosted the Dai Savings Rate’s rewards for its users if they deposited via its Earn program.

Featured image via Pixabay.