Data from the Bitcoin blockchain suggests that bitcoin whales – including institutional investors – have been accumulating BTC this year, especially when the price of the cryptocurrency dropped.

A report published by the research arm of crypto exchange OKEx, OKEx Insights, and blockchain data firm Catallact, found by looking at the flagship cryptocurrency’s blockchain data that while the smallest transactions – between 0 and 1 BTC – make up the “lion’s share of USD value changing addresses on the Bitcoin blockchain,” large transaction patterns suggest accumulation occurred.

Both firms analyzed data from January 20’20 to the beginning of August 2020, and found that the smallest BTC transactions up to 0.1 BTC- attributed to retail investors – closely tracked the price of the cryptocurrency.

This, OKEx wrote in its report, suggests “retail investors buy and sell relatively small amounts of BTC as the cryptocurrency’s price fluctuates,” which would also mean they can more easily be “shaken out” of the market when volatility surges. As BTC approached its third block reward halving in May 2020, for example, these transactions plummeted, suggesting a wait-and-see approach.

Medium-sized transactions, those between 10 and 100 BTC, on average decreased immediately after the COVID-related market crash in March, and remained lower than before that event, even though they trended upwards since late June. These transactions, OKEx wrote, likely came from BTC miners or larger retail investors.

The number of daily transactions between 100 and 1,000 BTC preceding the crash in March was lower than those between 10 and 100 BTC. The data gets more intriguing moving on to transactions of over 1,000 BTC.

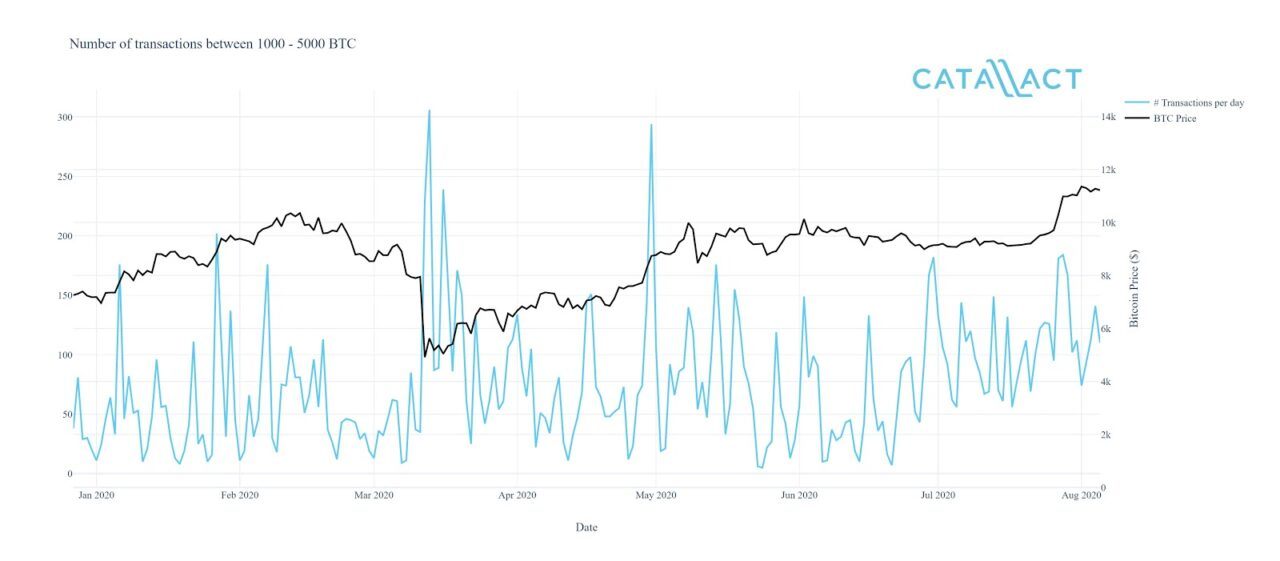

Per the report, transactions from crypto whales with over 1,000 BTC ($10.7 million) surged in March and when BTC approached the psychological $10,000 level. Transactions between 1,000 and 5,000 BTC, on the other hand, entered an upward trend at the end of June, as the price of BTC consolidated.

This suggests institutional investors and other large players were accumulating bitcoin at the time, often with transactions up to 5,000 BTC ($53.9 million). The period coincides with central banks’ economic stimulus measures – including quantitative easing – which spurred the purchase of hard assets.

OKEx warns, however, it’s not possible to “clearly differentiate what actual activity took place,” meaning the accumulation remains only a possibility. For transactions between 5,000 and 10,000 BTC ($107.8 million), the trend changed.

Per the report, these transactions saw “repeated spikes throughout the entire season of BTC’s price consolidation,” from mid-May to the end of mid-July. Two conclusions can be drawn from that data: exchanges were moving large amounts of BTC -which could happen for multiple reasons – or large institutional players were accumulating or distributing large sums of BTC.

Alternatively, there is the possibility that large institutional players and big-money whales accumulated or distributed large sums of BTC during this consolidation period in the expectation that the price of the leading cryptocurrency would increase further or decrease.

The second option is in line with various headlines we’ve seen so far this year, suggesting institutional investors and billion-dollar firms are allocating wealth into bitcoin and the cryptocurrency space.

As CryptoGlobe reported, legendary billionaire macro investor Paul Tudor Jones II, the founder and Chief Investment Officer of asset management firm Tudor Investment corporation, has revealed he has over 1% of his assets in bitcoin.

The billion-dollar business intelligence software firm MicroStrategy has made a massive $250 million bet on bitcoin, investing in the cryptocurrency as part of its capital allocation strategy. Looking at the percentage of total transactions over 1,000 BTC, OKEx and Catallact also found these increased after March’s price crash, and in mid-June.

The report concludes that while small retail investors were seemingly “shaken out” of the market by the COVID-related market crash and the third block reward halving, some large retail players and miners appear to have accumulated. Large players in the space, however, became “very active when the price of BTC crashed.” This implies whales and institutional investors bought the dip.

Featured image via Pixabay.