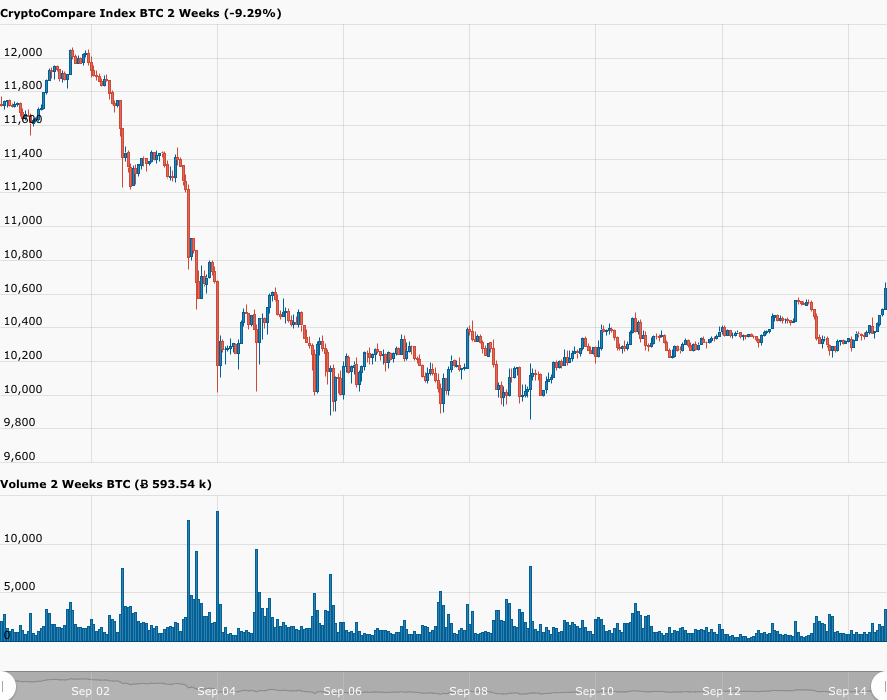

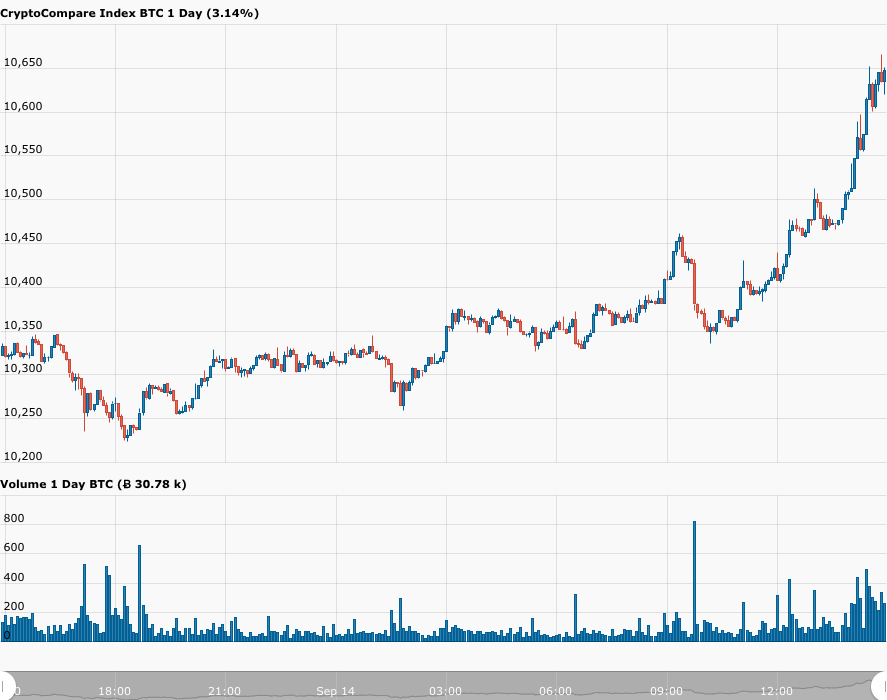

According to data from CryptoCompare, on Monday (September 14), around 13:50 UTC (or 10:50 Eastern Time) the Bitcoin price broke through the $10,650 level for the first time since September 4, helped presumably by U.S. stocks rebounding after a two-session sell-off last week.

Popular Dutch crypto analyst/trader Michaël van de Poppe, offered this technical analysis of Bitcoin’s price action:

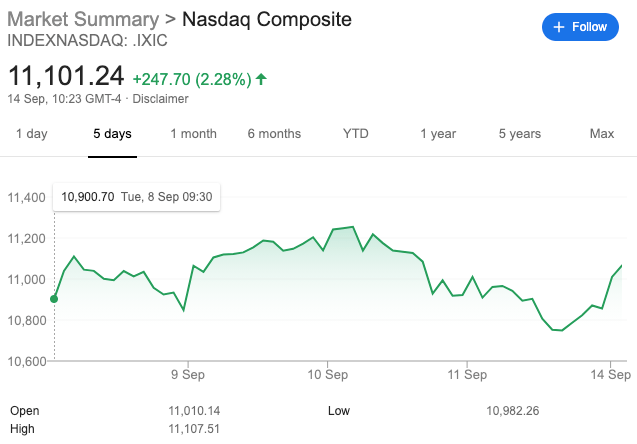

As for U.S. stocks, here is how the Nasdaq Composite has performed over the past five trading sessions:

As you can see, so far today, the Nasdaq Compsite index has gone up 247.70 (or 2.28%). As for the Dow Jones Industrial Average, it is up 1.28%; and finally, the S&P 500 has gained 1.69%.

According to a report by CNBC, “tech sentiment was lifted by news of Nvidia buying chipmaker Arm Holdings from SoftBank for $40 billion.” The report pointed out that outside the tech sector, investor sentiment got a boost by the news that British-Swedish multinational pharmaceutical and biopharmaceutical company AstraZeneca has “resumed phase three trials for its coronavirus vaccine in the U.K. following a halt for safety concerns.”

Another macro factor that may have helped the Bitcoin price surge around 3% today is the decrease in the value of the U.S. dollar as measured by the “U.S. Dollar Index” (DXY), which is “an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies”. These other currencies are EUR, GBP, JPY, CAD, SEK, and CHF.

The drop in the value of the U.S. dollar may also have helped the price of spot gold to increase by $18.80 (or 0.97%) to reach $1,958 an ounce.

Charles Edwards, Co-Founder of digital asset management firm Capriole Investments, says that Bitcoin is still undervalued at these levels:

Data from on-chain market intelligence startup Glassnode shows that the indicator “Supply Last Active 7y – 10y” reached a three-year low of 1,333,450.479 BTC earlier today (at 15:15 UTC). This metric represents “the amount of circulating supply last moved between 7 years and 10 years ago.”

Prominent macro-economist and crypto analyst Alex Krüger explains below why shorting crypto in the current market environment is a bad idea:

Last Thursday (September 8), CNN anchor Julia Chatterley did an interview with Ruchir Sharma, Head of Emerging Markets and Global Macro at Morgan Stanley Investment Management.

Sharma believes that once we have a reliable COVID-19 vaccine, inflation could return much sooner than some people expect, and perhaps as early as next year.

He also feels that commodities are more attractive here than tech stocks, which have gone up so much already this year.

Sharma was also asked what he thinks about gold and cryptocurrencies, and this was his reply:

It’s a generational thing. I think some of the older [investors] are still buying gold, and millennials are buying more of the Bitcoins and the cryptocurrencies…

There is this lingering feeling out there that given what central banks are doing in terms of printing so much money, there is a search for alternative assets.

Featured Image by “WorldSpectrum” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.