On Tuesday (August 11), Russia reported that it had became the first country to register a COVID-19 vaccine, which according to President Vladimir Putin “has passed all the necessary checks.”

A Russian COVID-19 Vaccine

News outlet RIA Novosti reported earlier today that President Putin said at a government meeting today:

As far as I know, a vaccine against a new coronavirus infection has been registered this morning, for the first time in the world… Although I know that it works quite effectively, it forms a stable immunity and, I repeat, has passed all the necessary checks.

He then added that one of his daughters had already been given this vaccine, and that he hopes that mass production can start in the near future.

CNBC says that phase III trials are set to start on Wednesday, and that “countries including the United Arab Emirates, the Philippines and Saudi Arabia are taking part in those trials.”

The CNBC report also mentioned that Russia’s sovereign wealth fund—the Russian Direct Investment Fund (RDIF)—mentioned in a statement “considerable” overseas interest in this vaccine:

We have received preliminary applications for over 1 billion doses of the vaccine from 20 countries. Along with our foreign partners, we are already prepared to manufacture over 500 million doses of vaccine per year in five countries, and the plan is to ramp-up production capacity even higher.

RDIF also believes that full-scale production could start as early as next month.

Although not everyone outside of Russia is fully convinced of the safety and efficacy of this vaccine—especially not former U.S. Food & Drug Administration (FDA) commissioner Dr. Scott Gottlieb—this announcement should make everyone at a minimum a bit more hopeful that at least one of the 26 COVID-19 vaccines that are in clinical evaluation stage according to the World Health Organization (WHO) will prove to be safe and effective and that it will be ready earlier than many had initially feared (i.e. the middle of next year).

According to a CNBC report from yesterday, Jeff Buchbinder, equity strategist at LPL Financial, said in a note:

Markets are looking forward to better days ahead… Although the timing is uncertain, the stock market is expressing confidence that the pandemic will end eventually with a vaccine—or multiple vaccines—and with help from better treatments in the interim.

Falls in the Prices of Silver, Gold, and Bitcoin

Several things seem to be contributing to the diminishing appetite of investors for safe haven assets such as gold :

- The potentially excellent vaccine news out of Russia, which means more interest in risk-on assets such as stocks and less interest in risk-off assets such as U.S. Treasuries, thereby increasing yield of U.S. government bonds.

- The U.S. Labor Department’s announcement that its producer price index (PPI), which historically has demonstrated a negative correlation with the price of gold, increased by more than 0.6% in July.

- Increased expectations for a new COVID-19 fiscal stimulus package in the U.S. that the White House, the Republicans, and the Democrats can live with, which is good news for U.S. stocks but puts pressure on U.S. government bond prices (thereby increasing their yields).

All precious metals fell today, with silver and gold at one point down more than six and four percent respectively. Currently (as of 15:25 UTC on August 11), silver is trading at $27.15 an ounce and spot gold is at $1947.12 per ounce.

Famous gold bug and Bitcoin skeptic Peter Schiff, who is the CEO of Euro Pacific Capital, a full-service, registered broker/dealer specializing in foreign markets and securities, and founder and Chairman of SchiffGold, a full-service, discount precious metals dealer, had this to say about gold’s price correction:

Bitcoin, which has lately been showing increasing positive correlation with gold recently, seems to have followed gold down.

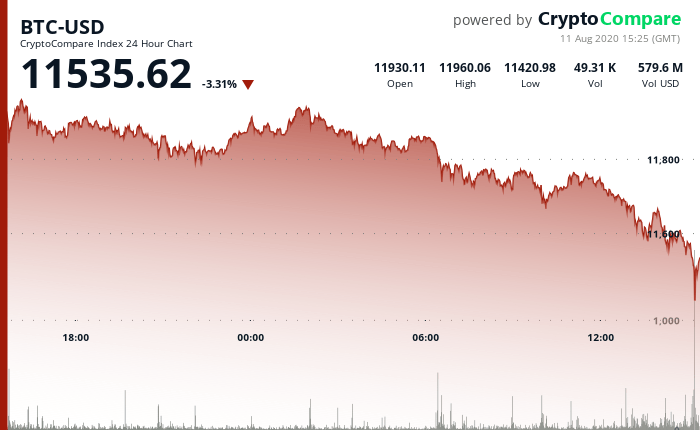

Although Bitcoin had an intraday high of $11,940 around 01:55 UTC (August 11), at the time of writing, it is trading at $11,535, down 3.31% on the day:

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.