Gold bug and crypto critic Peter Schiff has bashed cryptocurrency asset manager Grayscale Investments for its “drop gold” ad campaign, as the firm plans to run another campaign advertising bitcoin.

On Twitter, Schiff claimed that since Grayscale Investments ran its original ad campaign telling investors to “drop gold” and instead invest in bitcoin – which is seen by some as gold 2.0 – the price of the precious metal went up 60%, while the price of BTC dropped 16%.

Barry Silbert, the CEO of the Digital Currency Group, of which Grayscale Investments is a subsidiary, responded to Schiff on social media correcting his math as at the time the TV ad started bitcoin was trading at $5,300, and is now close to $12,000.

Silbert further argued that comparing the performance of gold in bitcoin “over literally any timeframe” would see BTC outperform the precious metal “in all cases.” Schiff replied, arguing that the price of BTC Silbert pointed to was the price of the cryptocurrency when it started rising and that “very few investors bought n at that price.”

Instead, the gold bug told the Silbert to the performance of Grayscale’s Bitcoin Trust Fund (GBTC) and added he would bet that most of the investors who invested in GBTC as a result of the TV ads are losing money as a result.

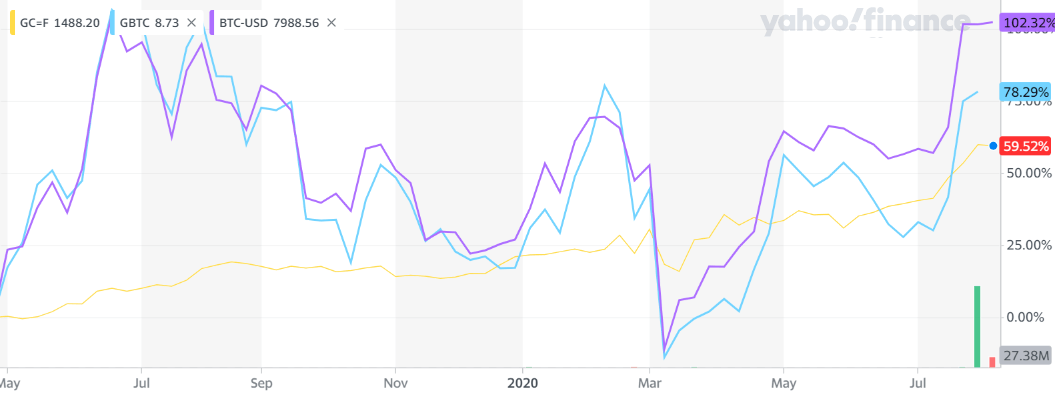

Data from Yahoo! Finance shows that while gold went up nearly 60% since the beginning of May 2019, bitcoin itself saw its price go up over 100% to date. Grayscale’s GBTC, on the other hand, went up 79%. It’s worth noting that by July the price of bitcoin had surged to $12,000, which would mean investors could merely be breaking even if they bought in then. GBTC investors would still be in the red.

Grayscale Investments as CryptoGlobe reported, has been seeing record inflows over the last two quarters, adding in $503.7 million in the first quarter of this year, and $905.8 million in the second quarter. In the first half of this year, the firm raised $1.5 billion thanks to growing demand.

The precious metal surpassed the $2,000 mark for the first time this year, as the ultra-low interest rate environment and hopes for more government stimulus to safeguard the economy have seen investors bet on the precious metal. Bitcoin, on the other hand, broke through the $10,000 mark last month and has been testing the $12,000 mark.

Featured image via Unsplash.