Aave, one of the hottest projects in the decentralized finance (DeFi) space, has several exciting new featured lined up for the upcoming phase/version 2 of the Aave Protocol.

What is Aave?

In case you are wondering about the name “Aave”, it is a Finnish word that translates to “ghost” in English, and it is was chosen by the team because they are focused on building an open and transparent DeFi platform.

Aave is being developed by a multi-cultural team, and London was chosen for its headquarters because the city has probably “the largest FinTech community in the world.”

Aave is “a decentralized non-custodial money market protocol where users can participate as depositors or borrowers.” You earn interest on the cryptoassets that you deposit, and those deposited assets can be used as collateral to borrow other cryptoassets.

Three of Aave’s most innovative features are Flash Loans, the ability to choose stable vs variable borrowing rate, and Credit Delegation.

The LEND token is used for protocol governance. LEND is “burnt based on the fees gathered in the protocol, so holders benefit on the reduction of the supply.”

On 29 July 2020, Stani Kulechov, Founder and CEO of Aave, published a blog post in which he introduced a tokenomics upgrade proposal called the “Aavenomics Proposal”, the purpose of which is to transition Aave to a fully decentralized governance model.

Under this proposal, a new governance token called AAVE will replace LEND. “LEND will be migrated to AAVE, via a Gensis Governance vote, at a rate of 100 LEND per 1 AAVE.”

Here is a good introductory video on Aave by Chris Blec:

What Is in Aave V2?

According to a blog post by Marc Zeller that was published on Thursday (August 14), the main new features/enhancements that Aave Protocol V2 will introduce can be divided into three catgeories.

User Experience

- Repay with collateral

- Debt tokenization and native credit delegation

- Fixed Rate Deposit

- Improved Stable Borrow Rate

- Private Markets

- Improved aTokens

- Gas Optimizations

Native Trading Functionalities

- Debt Trading

- Collateral Trading

- Margin Trading

Governance

- Vote Delegation

- Cold Wallet Voting

- Distribution of Governance Power to Users

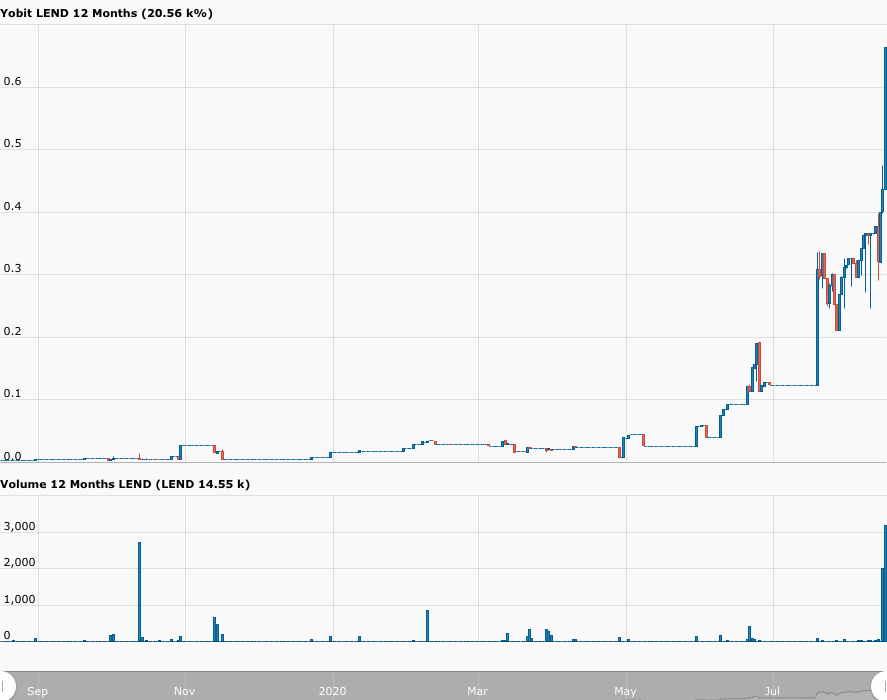

How Aave (LEND) Has Performed in 2020

According to data from CryptoCompare, LEND is currently trading at 0.6633, which means that it is up over 52% against USD in the past 24-hour period, and in the year-to-date (YTD) period, LEND’s return on investment (ROI) vs USD is an incredible 4252%:

Aave Manages to Exceed $1 Billion in Total Value Locked (USD)

On Saturday (August 15), Aave managed to hit another milestone—$1 billion in total valued locked (TVL)—thereby becoming only the second DeFi platform to do so (after Maker).

According to Defi Pulse, at the time of writing (i.e. as of 21:00 UTC on August 16), Aave’s TVL in USD stands at over $1.09 billion.

Featured Image Courtesy of Aave