Chainlink investors are reportedly “increasingly uncertain” of LINK’s continued rally, as the cryptocurrency is now up over 123% so far this year and is now the fifth-largest cryptocurrency by market cap.

According to blockchain analytics firm Santiment, LINK investors are starting to show signs they are “becoming increasingly uncertain in its prolonged rally,” which could mean a sell-off is set to happen in the near future. The firm detailed there were three metrics showing the prolonged rally may be over.

For one, LINK deposits into cryptocurrency exchanges have reached an all-time high, suggesting token holders are moving their funds to take profits on trading platforms. Santiment’s data shows that previous exchange deposit spikes coincided with Chainlink’s previous highs.

Moreover, the number of daily active LINK deposits has been surging, while Chainlink’s mean dollar invested age metric started plunging. These factors show the cryptocurrency, which is up 593% in the last 12 months, could be about to slow down.

Analysts at Zeus Capita LLP, which some Twitter users have linked to Nexo Finance, also believe LINK’s price rise is about to end, and in fact have published reports suggesting they entered short positions on the cryptocurrency, believing it will drop to $0.07.

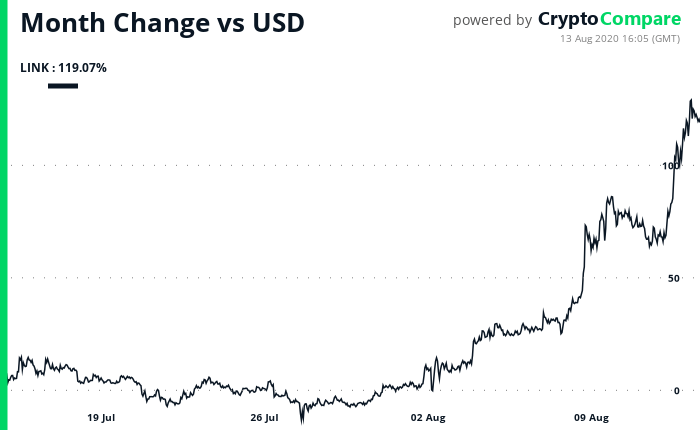

At press time, CryptoCompare data shows LINK is trading at $16.65 after rising 4% in the last 24-hour period, and 119% in the last 30 days.

In its report, Zeus Capital assets it believes Chainlink has been exaggerating its partnerships, and claims the project was created to enrich its founders. Allegedly unmasking Chainlink’s modus operandi, Zeus Capital argued it starts with “a large company showcasing some of their products,” only to then “casually” mention Chainlink as a “theoretical intermediary in delivering the product to blockchain clients.”

Zeus Capital further alleged in its reports that Chainlink engages in pay-for-play schemes and has a plethora of integrations with “dead” projects, while allegedly lying about the “size and type of the relationships.”

Its infamous report concludes:

Based on our findings we have opened a short position in LINK and recommend you doing the same with a target price of USD 0.07 and potential upside of nearly 100%.

Some users have accused Zeus Capital of spreading fear, uncertainty and doubt. Nexo Finance, which has been linked to Zeus Capital, has distanced itself from the firm.

Featured image via Pixabay.