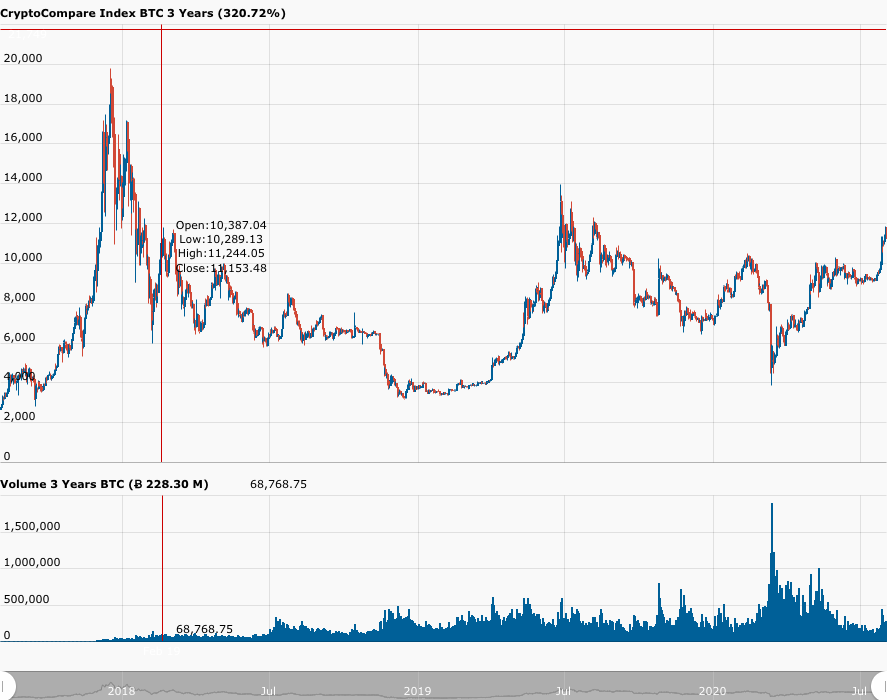

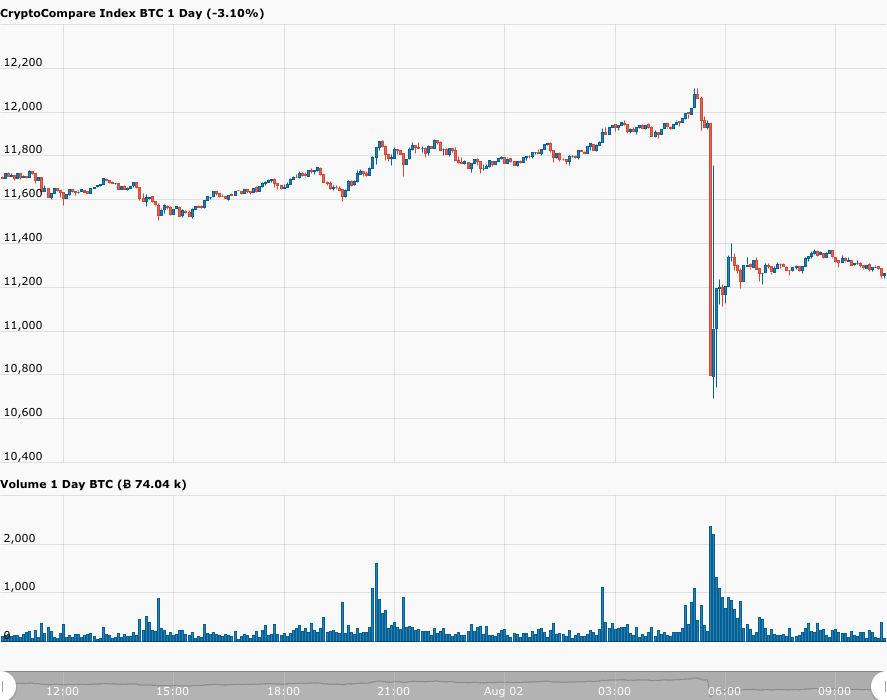

According to data from CryptoCompare, around 04:05 UTC on Sunday (August 2), Bitcoin broke through the $12,000 resistance level for the first time since 21 January 2018 before reaching $12,019, and by 04:15 UTC, it got to the intraday high of $12,080:

However, in the next 35 minutes, it managed to fall more than 11%:

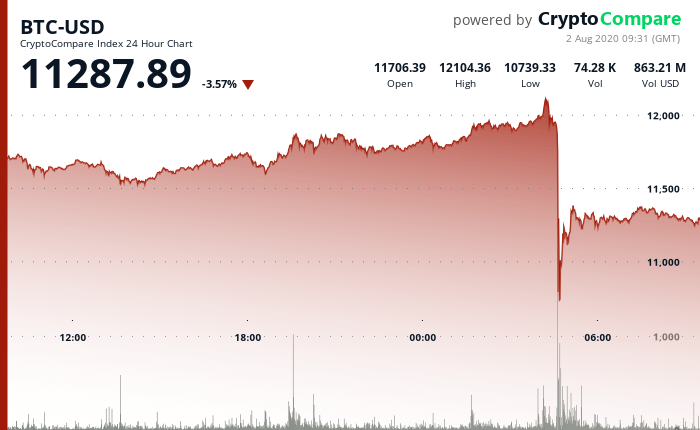

That was the bad news; the good news is that since then Bitcoin has managed to recover somewhat, and it is currently (as of 09:31 UTC on August 2) trading around $11,287, down 3.57% in the past 24-hour period:

Of course, when you consider that Bitcoin started the weekend (i.e. 00:00 UTC on August 1) at $11,352, then Bitcoin is down only 0.57% so far this weekend.

Popular crypto analyst/trader Josh Rager, who is also a Co-Founder of online crypto learning platform Blockroots, as well as an advisor to several blockchain startups, used turbulence that can occur during flights as metaphor to describes today’s earlier drop from $12,080 (at 04:15 UTC) to $10,694 (at 04:40 UTC):

One crypto analyst offered this advice for newcomers to the crypto space:

As is usually the case with these flash crashes, today’s huge drop in the price of Bitcoin was mostly due to the liquidations of BTC futures contracts on crypto derivatives exchanges.

In total, according to data from Bybt, around $1.1 billion worth of cryptoasset futures belonging to roughly 70,000 traders got liquidated during the long squeeze, approximately $647 million of which was Bitcoin futures (and almost $165 million of which was in Ether futures).

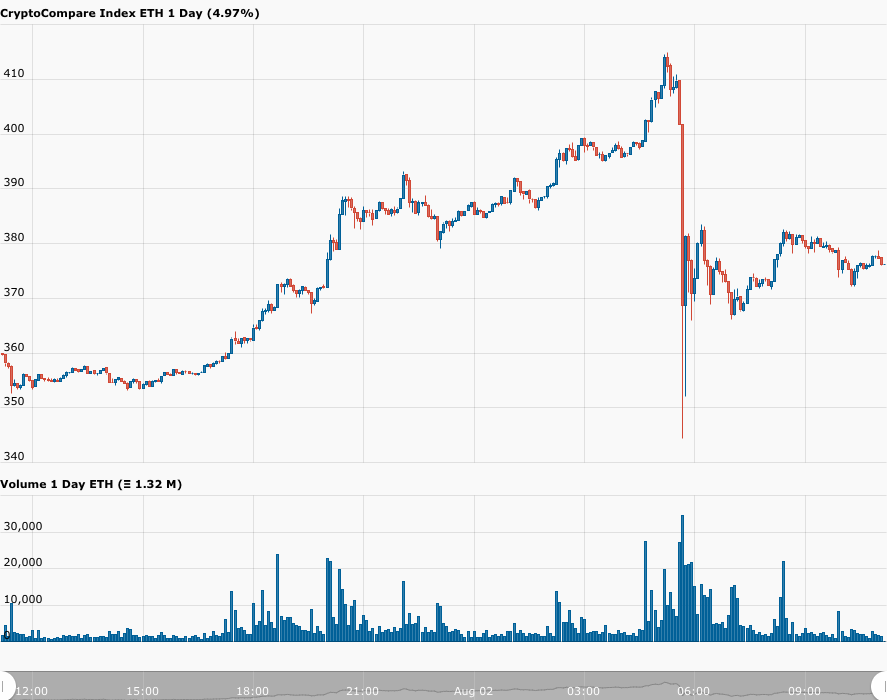

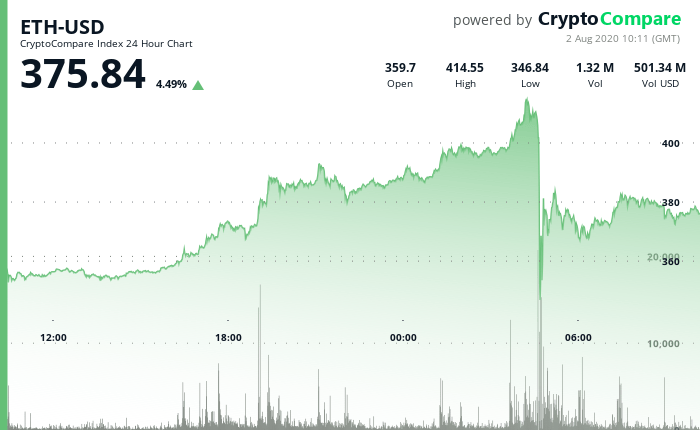

As for Ethereum, today, Ether (ETH) had its own flash crash around the same time as Bitcoin, falling 17% from an intraday high of $414,95 (at 04:15 UTC) to $344,45 (at 04:40 UTC):

Currently (as of 10:11 UTC on August 2), Ether is trading at $375.84, up 4.49% in the past 24-hour period:

Featured Image by “skeeze” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.