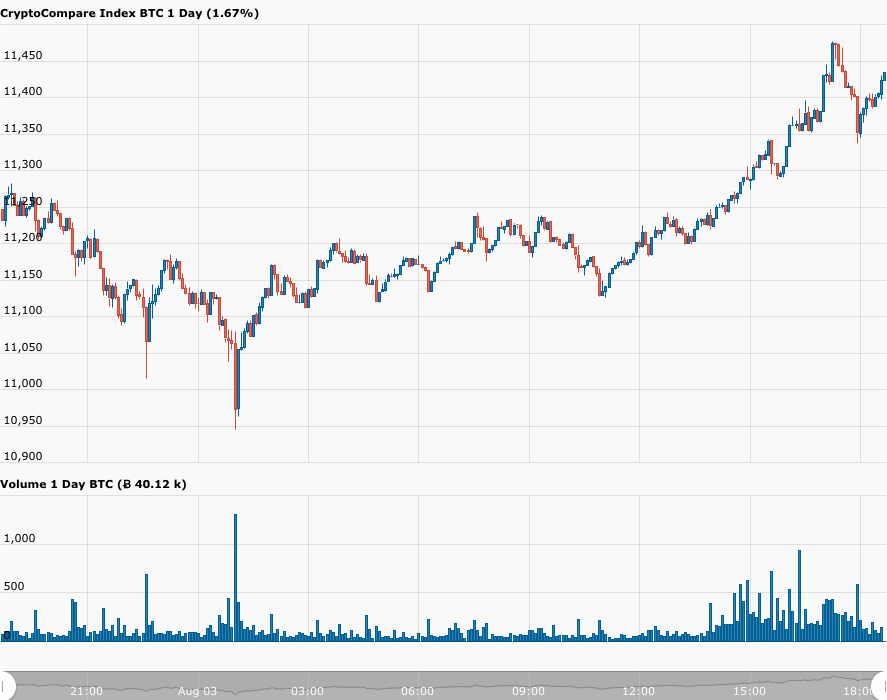

According to data from CryptoCompare, around 16:15 UTC (i.e. 12:15 Eastern Time) on Monday (August 3), Bitcoin flirted with $11,500, reaching an intraday high of $11,476, which was 4.85% higher than the price it had at the start of the day.

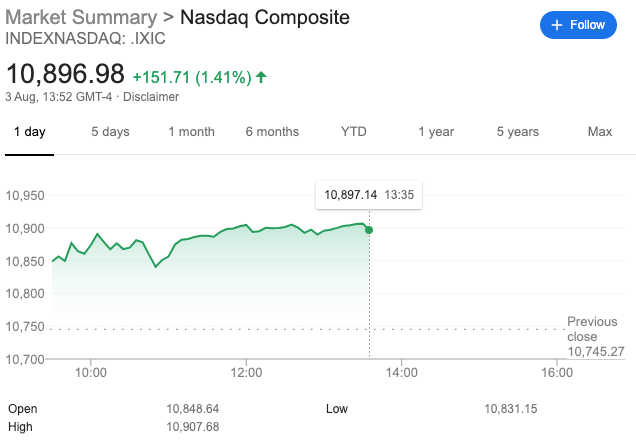

Due to the positive correlation between Bitcoin and U.S. equities that we have witnessed episodically throughout the current COVID-19 pandemic, it is worth pointing out that Bitcoin managed to reach this price level around the same time that the Nasdaq Composite, which is currently (as of 17:51 UTC) up 1.42%, was setting a new all-time high.

According to a report by CNBC, today’s gains in the U.S. stock market are thanks to the following tailwinds:

- Investors continuing to throw money at tech stocks since technology giants such as Apple, Microsoft, Amazon, Google, and Facebook seem like the closest thing to a sure thing in these difficult times.

- The U.S. government’s approval (in principle) of a potential takeover of U.S. operations of TikTok by Microsoft Corp. has helped Microsoft shares to go up nearly 5% today.

- Investor’s delight with “an earnings season in which companies are beating estimates at a record rate” ( FactSet says that as of last Friday, 84% of S&P 500 companies had beaten analysts’ earnings estimates).

As for where Bitcoin goes from here, it is impossible to know the answer in the short-term. However, many Bitcoin HODLers remain very bullish on the medium to long-term.

One of those people is Rafael Schultze-Kraft, who is Co-Founder, Data Scientist, and Chief Technology Officer at on-chain market intelligence startup Glassnode, and in the tweet below he explains one reason to feel “extremely bullish”:

Featured Image via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.