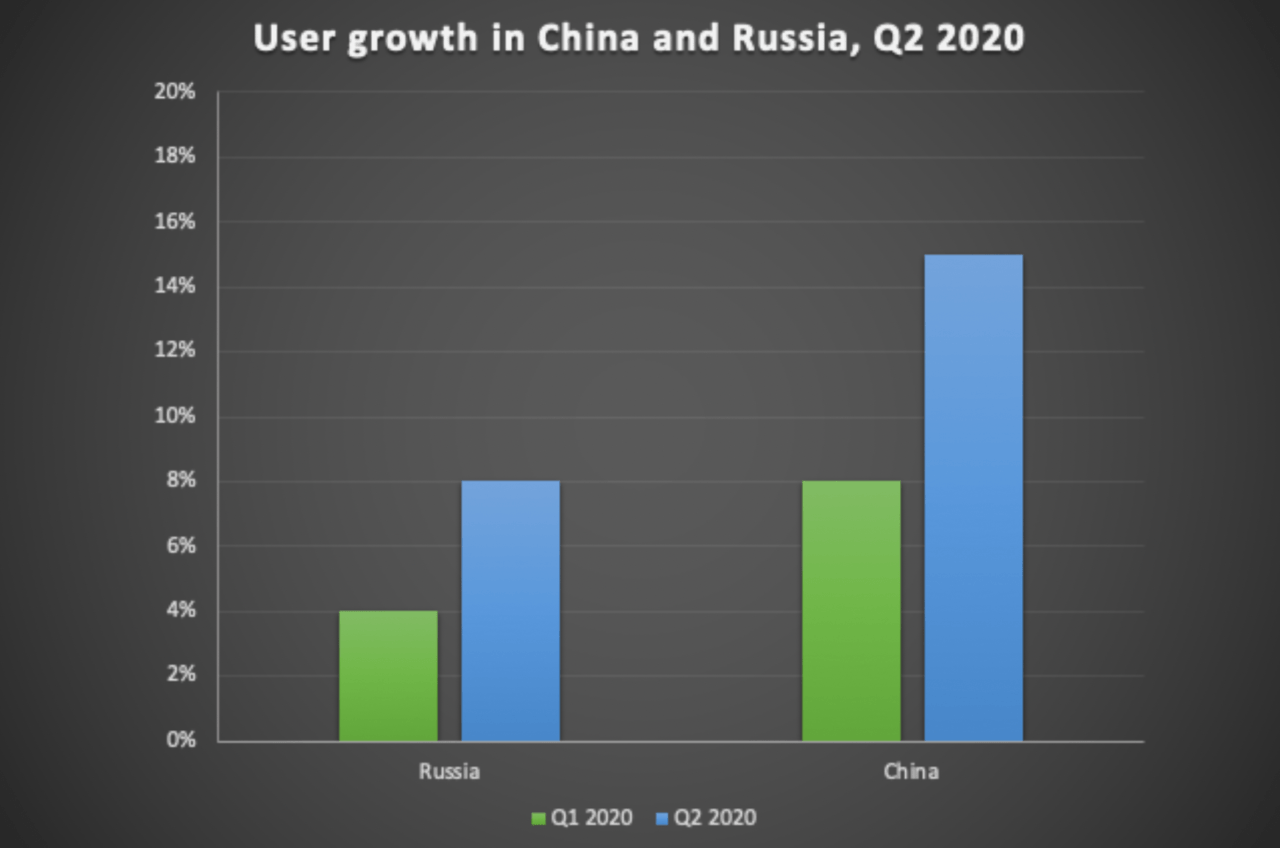

The decrease in cryptocurrency volatility, which has been ongoing for about two months now, has not significantly affected trading volumes in the second quarter of 2020. While user activity as a whole remained at the same level, two countries — China and Russia — showed significant growth in the number of new registrations and deposits.

According to our research, the number of Russian users doubled compared to the previous quarter with an increase in the total share of Russian-speaking users from 4 to 8%. In China, the number of registrations has grown by 80%.

Russia

The number of deposits made by users from Russia increased by 1136% compared to the previous year, and by 80% compared to the first quarter of 2020. Over the past quarter, traders showed particular interest in buying Bitcoin, USDT and Bitcoin futures. In particular, the exchange has seen a 5% increase in Bitcoin trading volumes in Russia, compared to Q1 2020. At the same time, the total number of deposits made by traders in the second quarter largely exceeded the number of withdrawals.

Exchange analysts attribute such dynamics to the economic situation in the country. Heightened volatility of the Russian Ruble (RUB) and lower interest rates on bank deposits have acted as contributing factors. As a result, more users with disposable income or savings have started turning to cryptocurrency instruments as a means of preserving and increasing capital.

In the second quarter of 2020, RUB not only approached cryptocurrencies in terms of the volatility index, but also weakened by 12% against the US dollar, while Bitcoin strengthened by 60%. At the same time, the buy and hold strategy took on prominence for users during this period, as traders preferred long-term investments to short trading.

The average deposit amounted to $700, and the average monthly sum of deposits increased to $2,300. According to Russian representatives of an exchange, this amount is close to the average bank deposit of individuals in Russia — $2,500, and may be due to the fact that over the past few months, Russians have been withdrawing money from banks due to lower bank rates, the ruble’s depreciation, and tax increases for bank deposit holders. In addition to economic factors, the restriction on foreign travel, which has not yet been lifted for residents of the country in connection with the coronavirus outbreak, can also be a contributing factor driving movement of assets from tourism spending to crypto.

China

In China, a similar trend is being observed with an annual increase in the number of deposits of 21% compared to last year, and a quarterly growth of 87%. The total share of deposits made over the past three months increased from 21% to almost 40%. The greatest asset in demand from April to June among Chinese users was USDT.

It is noteworthy that in China, the demand for such financial instruments as cryptocurrencies and bonds has grown by several times compared to last year amid tightening policies for those who hold bank deposits and take money out of the country.

By analogy with Russian users, the Chinese see cryptocurrency funds and stablecoins as a more reliable mechanism for protecting their capital than keeping money in banks.

For us at AAX, we have seen a similar uptake among Russian and Chinese users. To accommodate these monetary flow, over the past month, we have added new fiat on- and off ramps with support for more than 20 fiat currencies, including RUB and CNY. We’ve furthermore noticed an increase interest in altcoins, rather than spot trading for Bitcoin. However, our USDT settled contracts for BTC as well as our competitive savings product for exchange token, AAB, remain our most popular products.

About AAX

AAX is the world’s first digital asset exchange to be powered by LSEG Technology. Offering OTC, spot, and futures, the exchange provides a highly secure, deeply liquid and ultra-low latency trading environment, with the lowest trading fees globally.

Open an account with AAX and experience the fastest exchange, with the lowest fees.