Yesterday (July 28), Robert Kiyosaki, the highly successful and world-renowned author of the “Rich Dad Poor Dad” series of personal finance books, told his 1.4 million Twitter followers that although he feels that gold may have peaked, he remains very bullish on silver and Bitcoin.

“Rich Dad Poor Dad“, which is one of the top 10 personal finance books of all time, is a book that “advocates the importance of financial literacy (financial education), financial independence and building wealth through investing in assets, real estate investing, starting and owning businesses, as well as increasing one’s financial intelligence (financial IQ) to improve one’s business and financial aptitude.”

Kiyosaki has been criticizing for the past few months the Federal Reserve’s response to the economic damage caused by the COVID-19 pandemic and strongly urging his large following on social media platforms such as Twitter and YouTube to protect themselves from what he feels is inevitable high inflation (and possibly hyperinflation) in the future by using their fiat holdings to buy silver, gold, and Bitcoin.

For example, this is what he tweeted on May 19:

Episode #263 of Anthony Pompliano’s “Pomp Podcast”, which was released on April 7, featured an interview with Kiyosaki.

During this interview, Pompliano (aka “Pomp”) asked about Kiyosaki’s latest thinking on “traditional inflation hedge” type assets such as silver and gold.

Here is what Kiyosaki said:

“Gold and silver are God’s money. Bitcoin is open source people’s money.”

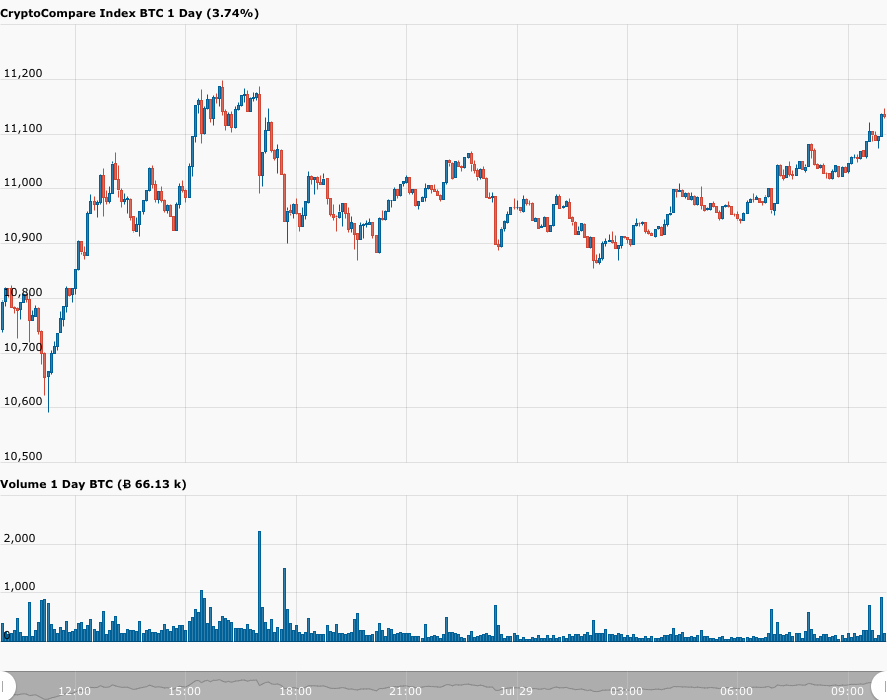

According to data from CryptoCompare, at 14:53 UTC (i.e. 09:53 ET) on July 28, Bitcoin was trading between $11,100 and $11,200:

This is when Kiyosaki sent out the following tweet:

CNBC contributor Dennis Gartman is the founder and publisher of “The Gartman Letter”, a daily newsletter he started in 1987 and (according to CNBC) clients of which include “many of the leading banks, broking firms, mutual funds, hedge funds, energy trading companies, and grain trading companies.”

Currently, the Crypto Fear & Greed Index, which is based on an analysis of “emotions and sentiments from different sources”, is currently telling us that we are in “Greed” category:

This should not be too surprising as many investors remain worried about debasement of fiat currencies, especially due to the money printing being done by central banks in order to fight the economic impact of the current COVID-19 pandemic.

According to a report by Bloomberg, yesterday, Goldman Sachs warned its clients that the U.S. dollar could be in danger of losing its status as the world’s reserve currency (although this seems highly unlikely in the near to medium future).

Goldman’s analysts said in this report:

“Gold is the currency of last resort, particularly in an environment like the current one where governments are debasing their fiat currencies and pushing real interest rates to all-time lows.”

They went on to say that there are now “real concerns around the longevity of the U.S. dollar as a reserve currency.”

Featured Image by “WorldSpectrum” via Pixabay.com