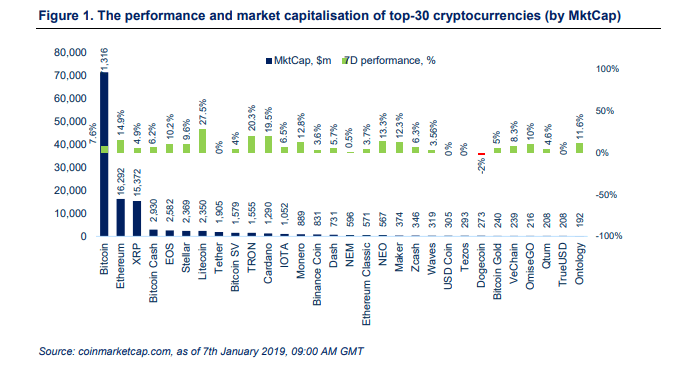

Since our latest edition (17th Dec), digital assets have bounced from the yearly lows of $104 billion back up to $146 billion on 24th Dec, representing a 40% spike in the total crypto market cap. From the beginning of 2019, digital assets were ranging around the $130 billion mark, until yesterday’s break out from an ascending triangle which resulted in a 5% gain, pushing the total crypto market price towards $138 billion. Volume has been bouncing in the $10 to $24 billion range, with almost $18 billion recorded this morning. Bitcoin dominance has fallen by 3.5% to 51.5%, with the price tag back above the $4,000 level, a 25% increase since the level seen 3 weeks ago. Ether is back as the second largest asset with an 80% gain since our last update, and is currently sitting at $156. XRP, the third largest asset is up 27.5% at $0.37.

Regulatory News

Two Congressmen Want to Exclude Crypto from Securities Law

The Token Taxonomy Act, proposed by congressmen Darren Soto and Warren Davidson, would look to exclude cryptocurrencies from securities laws.

The SEC Brought 90 Crypto Cases over The Past 2 Years

According to a report from the WSJ, the SEC and state regulators brought more than 90 crypto-related cases over the past 2 years, which resulted in the recovery of $36 million of investor money.

The FCA Opened 67 Inquiries into Cryptocurrency Projects

As of 12th November, the UK’s Financial Conduct Authority has opened inquiries into 67 crypto firms of which 49 have been closed, leaving 18 businesses under investigation.

New York Forms Crypto Task Force

New York State is creating a task force to study cryptocurrencies and blockchain technology in order to provide proposals on how the state may best regulate, define and utilize cryptocurrencies as well as providing general overviews of the space.

Crypto Market News

Facebook Works on Stablecoin for WhatsApp Transfers

Facebook is developing a stablecoin which will let users transfer money on its WhatsApp messaging app, initially focusing on the remittance market in India, according to Bloomberg.

Chinese Miners in Delay with IPO

Due to the general market conditions in 2018, the Hong Kong Stock Exchange is reluctant to approve the IPO applications of Chinese mining equipment manufacturers.

Tether has Sufficient Accounts According to Bloomberg

According to a report conducted by Bloomberg, controversial stable coin Tether is most likely backed by equivalent USD deposits.

Over 4,800 Pump & Dump Schemes Identified

Researchers from the University of New Mexico have identified over 4,800 pump and dump schemes from Telegram and Discord channels over a six month period in 2018.

Bitfinex Launches Margin Trading for Tether

Cryptocurrency exchange Bitfinex has launched margin trading for the USDT/USD pair, which will enable its users to hedge the exposure taken on stablecoins.

Additional 2 Million Tokens were Found in BTCP

Crypto analytics platform CoinMetrics, has revealed an additional 2 million tokens ($3.9 million) were secretly minted to claim a total supply of 20.4 million. The Bitcoin Private team has confirmed this and is currently investigating whether additional coins were transferred to an exchange or used elsewhere.

GMO Quits Manufacturing of Miners Japanese internet company

GMO will no longer develop, manufacture and sell cryptocurrency mining machines after extraordinary losses of $218 million in Q4 2018.

Ledger and Trezor Weak Spots Exploited

Researchers from wallet.fail demonstrated a series of attacks against hardware wallets Trezor and Ledger, showing that even hardware can be compromised.

Italy Forms Blockchain Group

The Italian Ministry of Economic Development has brought together 30 experts to develop the nation’s blockchain strategy.

WSJ Reports ICO Plagiarism

The Wall Street Journal has analyzed 3,300 ICOs and found that 16% of them showed signs of plagiarism.

Past Weeks in Funding

Lightning payments platform OpenNode raised $1.25m from Draper Associates; DCG and Peter Thiel are backing Layer1 crypto fund with $2.1m; STO issuance operator Abacus raises $2m from YC and Coinbase; Nomics, crypto trading data firm, raised $3m from DCG, Coinbase and others in Series A round; $182.5m raise for Bakkt; and Waves raised $120m to roll-out a private version of its blockchain.

Security Token News

Tokensoft Partners with Coinbase to Offer Security Token Custody

Security Token Offering platform Tokensoft announced a partnership with Coinbase to provide a custodial solution for its clients.

Tokeny Launches T-REX Standart Tokenization platform

Tokeny officially released open source security token standard T- Rex, a token for regulated exchanges designed to allow issuance and trading in a compliant manner.

Medici Ventures Buys 29% Stake Using Blockchain for Transfer

A subsidiary of overstock.com, Medici Ventures, has acquired a 29% stake in Chainstone Labs via a $3.6 million security token transfer on Ravencoin blockchain. Chainstone Labs is focusing on custodial and management services in the security token space.

Issuance and Primetrust Partnership

Another security token issuer, Issuance, has announced a new partnership with crypto custodial firm Prime Trust.

STO Global-X Releases STGX

Singapore-based STO Global-X is launching an end-to-end security token platform, STGX, designed for the issuance, management and trading of security tokens.

Tokenized Securities on EOS Blockchain

The first tokenized securities protocol called Financial Securities Protocol is coming to the EOS blockchain in order to “realize high throughput scalable financial applications”.

DX.Exchange to Digitize US Stocks Market

Estonian-based crypto startup DX.Exchange, is launching a trading platform allowing its clients to purchase 1:1 backed real world stocks, entitling them to the dividends that the stocks are worth. The EU regulated platform is initially offering tokenized shares of Google, Apple, Amazon, Facebook, Microsoft, Tesla and other tech companies.