Last week saw numerous important and positive institutional and regulatory announcements. Ohio announced it will allow companies to pay taxes with bitcoin, VanEck and Nasdaq partner to launch bitcoin futures and two bitcoin addresses were sanctioned by OFAC.

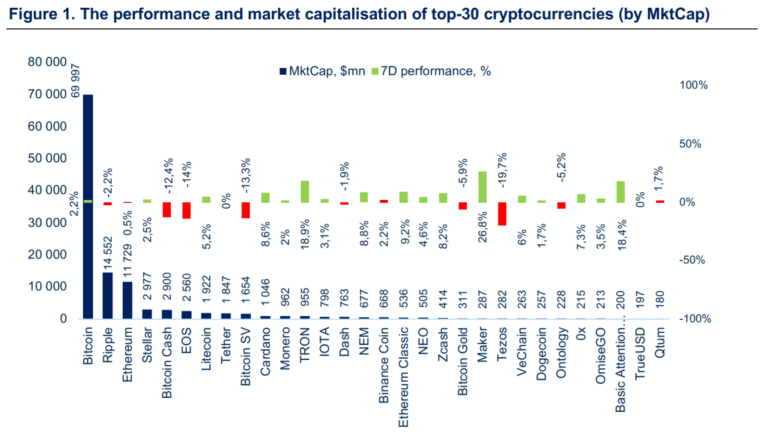

Bitcoin’s dominance fell from 53.9% where it was a week ago, to 53.5%. The total crypto market rose by 2.1% and overall volume has plunged by 30%. Bitcoin is slightly up by 2.1% Ethereum is up by 0.5%, XRP is down by 2.2%, and EOS is down by 14%. Best performers among top-40 crypto were Maker (20.7%) Waves (44.7%) and Digibyte (15.8%).

Digital assets attempted to make a recovery after a week of heavy losses, where most of the cryptocurrencies found preliminary bottoms. The total market cap has bounced from its intra-week low at $118 to $143 billion, which represents a spike of more than 21%. However, as of this morning, all of the top-30 assets are back in the red, with bitcoin down almost 4% below $4,000, Ripple -2.4%, Ether -3.8% and the total market cap is at $130 billion.

Cryptocurrency Regulatory News

Ohio Allows Companies to Pay Taxes with Bitcoin

Ohio has become the first US state to allow state-based companies to pay taxes with Bitcoin. In order to become eligible, businesses will have to register on ohiocrypto.com, add tax details and pay the amount via a compatible wallet. All the payments will be processed via payment processor BitPay, which will convert bitcoins to dollars. Previously, Arizona, Georgia and Illinois considered introducing this as an option, however the plans were cancelled due to insufficient votes for such a proposal.

10 Leading Crypto Firms Establish New Code of Conduct

Galaxy Digital, Genesis, Cumberland, Paxos and other leading crypto firms have formed the Association for Digital Assets Market (ADAM) in order to legitimize the “still- nascent” digital asset space. ADAM aims to work with regulators to help with laws as well as earn more trust in areas such as efficient trading, custody, clearing, and settlements of cryptocurrencies.

US Regulator Adds Two Iranian Bitcoin Addresses to Sanction List

The Treasury Department’s Office of Foreign Assets Control (OFAC) has for the first time added two Bitcoin addresses to its Specially Designated Nationals list. The two addresses are tied to Iranians who facilitated bitcoin ransom payments and exchanged them into Iranian rials on behalf of creators of malicious ransomware.

SEC Chairman Jay Clayton Interview at Consensus Invest

SEC Chairman Jay Clayton, giving his own views and not those of the SEC, hinted that most ICOs are unregistered token offerings, and that what is holding up the ETF approval is market manipulation and lack of adequate custody solutions. He added that Bitcoin is not a security and that DLT has incredible promise in terms of market efficiency. The full interview can be seen here.

Japan is Set to Introduce New ICO Regulations

Japan’s regulators will be introducing new ICO regulations, where ICO issuers will be required to register with Japan’s Financial Service Agency (FSA). The FSA further classified tokens into three categories: a) virtual currencies without issuer, b) virtual currencies with issuer and c) tokens with issuers that are also obliged to distribute revenues. The first and second type of tokens are subject to settlement regulation as outlined in The Financial Instrument and Exchange Act, and the third type of tokens are subject to investment regulations of the same Act.

G20 Leaders Call for International Cryptocurrency Taxation

The 20 member states gathered in Buenos Aires have called for the taxation of cross-border electronic services such as cryptocurrencies. Member states are working on a new bill and its final version is expected to be issued by 2020.

Cryptocurrency Market News

Bitcoin Miners Shutting Down

According to the third largest Bitcoin mining pool, F2pool, between 600,000 and 800,000 miners have closed their operations since mid-November. In particular, those with older equipment are the ones who were not generating enough profit.

Nasdaq to Launch Bitcoin Futures in Q1 2019

The world’s second largest stock exchange Nasdaq, is following NYSE with an announced partnership with VanEck to launch regulated and surveilled bitcoin futures in Q1 2019.

Steemit Cuts of 70% of its Staff

The social media platform powered by blockchain technology has laid off 70% of its staff due to poor market conditions and the cost of running full STEEM nodes. The rest of the team will work on reducing server costs by shrinking the size of its blockchain and dependence on Amazon AWS. STEEM is currently down 96% from its all-time high.

Amazon Launches Two Blockchain Products

After the introduction of Amazon AWS blockchain templates earlier in April, the firm will be launching additional blockchain-oriented products to its customers. Amazon Quantum Ledger Database (QLDB) is a “fully managed ledger database that provides a transparent, immutable and cryptographically verifiable transaction log owned by a CENTRAL trusted authority”. The other product is Amazon Managed Blockchain, which aims to support users in being able to easily create and manage blockchains when creating open source frameworks like Hyperledger and others.

Coinbase Launches OTC Desk and Lists Zcash

The largest US-based crypto exchange Coinbase has launched the OTC trading desk for its institutional clients using Coinbase Prime. According to the Head of Sales, Christine Sandler, the OTC desk will likely be integrated with Coinbase Custody. Coinbase is also widening the list of offered assets, which was announced via a blog post, and the company will list privacy-oriented cryptocurrency Zcash (ZEC) on its trading platform Coinbase Pro (former GDAX).

Huobi Opens Derivatives Trading Market

Announced during New York’s Consensus conference, Singapore-based exchange Huobi is launching the Huobi Derivative Market, which will allow its customers to purchase and sell cryptocurrencies at predetermined prices at specified times in the future.

Last Week in Funding

Security token project Securitize raised $12.75 million in a Series A round led by Blockchain Capital and with participation from Coinbase Ventures and Ripple Xpring Fund. Crypto analytics start up Flipside raised $4.5 million in a seed round with participants which included DCG and Coinbase Venture.

Security Token Offerings (STOs)

Harbor Officially Launched Its Platform

Harbor, the security token focused project backed by Andreessen Horowitz, Pantera and others, has launched its platform for issuance of tokenized securities. From the start, Harbor will offer the sale of 955 tokens ($21k each), which represent dorms of students from the University of South Carolina which will be tokenized.

Malta Digital Exchange Agrees to List FBC Token

MDX has signed a Memorandum of Understanding with Frankfurt-based p2p finance platform Finbc, which is planning their STO in the upcoming months. Finbc will be joining Canamex Gold’s silver and gold backed securities which will also be listed on MDX.

Why Tokenization Protocols Threaten Investment Banking Business

In a blog post written by former Goldman Sachs banker and founder of Decipher Capital, Joel Camacho, he explains why tokenization will disrupt underwriters of debt and equity from the traditional investment banking space.

Europe’s First Tokenized Equity

Berlin-based end-to-end security token platform, Neufund, is offering Europe’s first tokenized equity issued under German jurisdiction to the general public. Fifth Force GmbH, the operator and legal entity behind Neufund, is issuing no more than 46 million of its own FTH tokens, representing 4,600 new shares of the company, raising €6.6 million at €125 million pre-money valuation. Minimum ticket size is €100,000 and public sale bonus is set for 40%.

Security Tokens Explained in Four Layers

In another blog, Security Token Group explains the four layers with are essential for any security token. Blockchain protocols are the first layer or technical backbone, Smart contracts are the second layer, also the most important part, Issuance platforms or creator of the token are the third layer and the fourth and final layer is Exchanges or liquidity provider.