Despite an exciting news week bitcoin volatility is at a three year low with strong support at around $6,400 and significant resistance at $6,850, many analysts are predicting an imminent breakout. The SEC reviewed decisions on nine Bitcoin ETFs, Gemini Exchange secured an insurance partner and cryptocurrency money laundering came back into the spotlight.

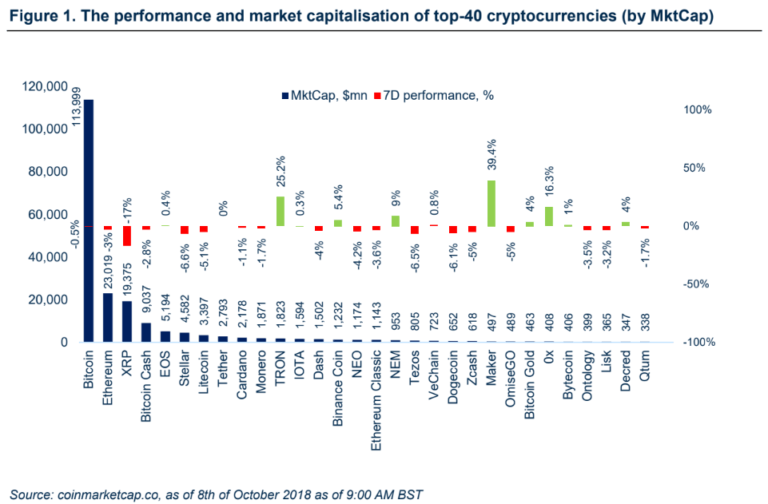

Digital assets remain indecisive and ranging sideways. Market leaders Bitcoin and Ethereum recorded a slight loss of 0.5% and 3% respectively. Best performers among the top-40 crypto were Maker (39%), Tron (25%), 0x (16%) and Siacoin (16%). This week’s worst performers from the top-40 assets were Ripple (-17%), Stellar (-7%) and Tezos (6.5%).

Cryptocurrency Regulatory News

European Union Markets Regulator Budgets €1.1 Million to Monitor Crypto Space

As revealed in The European Financial Markets 2019 Annual Work Programme, The European Securities and Markets Authority (ESMA) is setting aside €1.1 million in order to monitor cryptocurrencies and other fintech activities within the region, in 2019.

US Customs Claims Possible Traceability of Digital Assets

Assistant Director of domestic operations within the Homeland Security Investigations (HSI) division of ICE, Matthew Allen, has discussed the role of cryptocurrencies in drug trafficking during a hearing before the U.S. Senate Caucus on International Narcotics Control. Allen discussed multiple types of cryptocurrency exchanges and how they may be used to facilitate money laundering. Peer-to-peer exchanges in particular, referring to startups which refuse to register as a money services business and do not follow compliance laws, are often used to ensure users remain anonymous. While cryptocurrencies make transferring value relatively easy, he contended, criminals still need to convert cryptocurrencies into fiat and vice versa. Allen stated that, “whenever monetary exchanges are made, a vulnerability is created” and he further added, “this is the time when criminals are most susceptible to identification by law enforcement means and methods”.

South Korea Policy Chief Calls for ICO Legalization

The Policy Chief of Korea’s Policy Committee, Min Byung-Doo, has spoken at the National Assembly’s plenary session to call for the legalization of ICOs, saying that token sales have become a global trend and he doesn’t “want the ICO door closed completely … The state should not ignore the issue”, Byoung-Doo also added that “fraud, speculation and capital laundering must be strictly prohibited” with the introduction of safety standards alongside a self- regulated crypto industry.

SEC Reviews Decision on Nine Bitcoin ETFs

After the rejection of nine Bitcoin ETFs, the SEC is asking for public comments on all nine proposals. A final decision is expected by 26th October. The Bitcoin ETF proposal by VanEck/SolidX is being reviewed separately, where a decision is expected in December.

Cryptocurrency Market News

Yale Endowment Enters Crypto Markets

A large endowment with almost $30 billion AUM has entered the cryptocurrency space. Yale Fund, which is led by David Swensen, invested in Sequoia Capital-backed Paradigm fund led by former Coinbase employee Fred Ehrsam, former Sequoia partner Matt Huang and Pantera Capital principal Charles Hoyes.

TD Ameritrade Backs Crypto Exchange

Retail brokerage firm TD Ameritrade and high-speed trading giant Virtu Financial are backing a new crypto exchange called ErisX, which plans to trade crypto and related derivates and hopes to bring digital assets closer to traditional asset classes. J.B. Mackenzie, TD’s head of futures and foreign exchange commented, “We wanted to find something that brings cryptocurrency to customers where they can see it on an actual exchange, something they feel comfortable with in regulated space”.

Gemini will Insure Digital Assets on their Platform

Crypto exchange Gemini has obtained insurance coverage for the digital assets it holds in custody. Insurance will be provided through a consortium of insurers arranged by Aon. According to Gemini Head of Risk, Yusuf Hussain “consumers are looking for the same levels of insured protection they’re used to being afforded by traditional financial institutions.”

Diar Reports $3.8 Billion Raised via VC by Blockchain Startups in 2018

Blockchain research group, Diar reports that blockchain and cryptocurrency-focused startups have raised nearly $3.9 billion through VC investments in the first three quarters of the year – that‘s up 280 percent when compared to the whole of 2017, it says.

WSJ Research Shows Nearly $90 Million Laundered Through Crypto Exchanges

A Wall Street Journal investigation identified nearly $90 million in suspected criminal proceeds that flowed through such intermediaries over two years. The Journal traced funds from more than 2,500 potentially criminal cryptocurrency wallets and identified $89 million laundered through 46 exchanges. Shapeshift CEO Erik Voorhees later hit back at WSJ calling the report ‘deceptive’.

Bitfinex Responds to Online Rumors

One of the largest and longest operating crypto exchanges, Bitfinex, which has been frequently accused of price manipulations mostly linked with Tether, has responded to recent online rumors regarding fiat/crypto withdrawals, links with Puerto Rican Noble Bank, and overall insolvency revealing its cold wallets addresses.

Token Security News

First Tokenized Condo in Manhattan

A luxury 12 unit apartment block in the East Village, Manhattan, is set to be tokenized on Ethereum. Investors will be able to purchase the ownership of a $30 million condo via Fluidity’s AirSwap which is an Ethereum-based tokenization platform.

Circle Acquires SeedInvest

Goldman Sachs-backed peer-to-peer blockchain startup Circle, is acquiring the largest equity crowdfunding platform and registered Broker-Dealer SeedInvest. With this acquisition, Circle is making a big push towards the security token space, and this acquisition will allow startups to raise capital through a regulated platform, access diversified portfolios of retail investors through Circle Invest, and get secondary market liquidity through Circle’s digital asset exchange Poloniex.