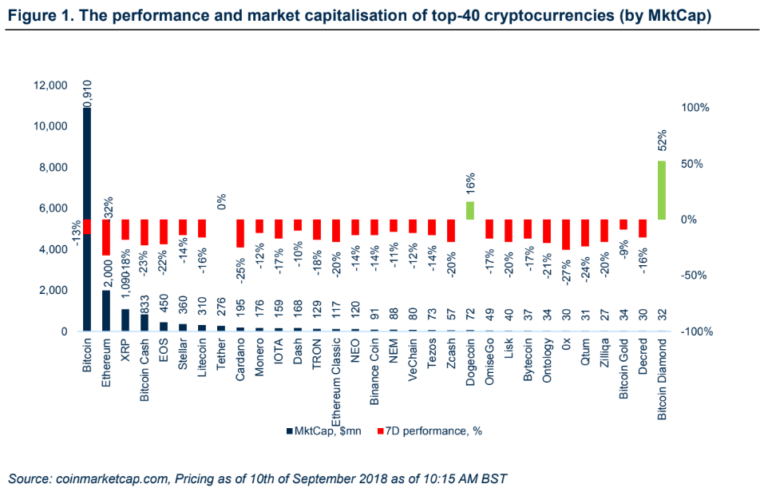

Cryptocurrencies saw a massive sell in the latter part of last week, the total market cap shrank by more than 16%. Bitcoin lost 13%, Ethereum is down by 31%, XRP -18%, EOS -23%, bitcoin has stablised in the past few days with the $6,000 support currently holding. Bitcoin volatility hit a 12-month low prior to the explosive drop.

Goldman Sachs had reportedly stopped working on a cryptocurrency trading desk, however, this was labelled as ‘fake news’ shortly after by a Goldman Sachs executive. Coinbase considers crypto ETF with help from BlackRock and launches GBP pairs. The EU and South Korea are making efforts to form responsible and concerted regulations to protect consumers in the entereing the crypto economy.

Cryptocurrency Regulation

EU Lawmakers look for new ICO regulation standard

On Tuesday, the group known as The All Party Innovation Group, held a meeting with the aim of creating new regulations for ICOs. The initial proposal, written by Member of the European Parliament, Ashley Fox, would establish an €8 million cap, introduce anti-money laundering policies and know your customer regulations for all Initial Coin Offerings within the EU. If the proposal is accepted and furthermore adopted, it would create a standardized system for token sales, allowing projects to raise funds within the 28 member states. According to the FCA, the regulatory body believes that between 25 and 81% of all ICOs may result in some level of fraud. Members of the European Parliament can officially submit amendments and proposals regarding the ICO regulation by 11th of September, thus setting the stage for further debate.

Australian Regulator will apply market rules to Crypto exchanges and ICOs

Australian Securities and Investments Commission (ASIC), which acts as a supervisory organ for financial markets in Australia, has revealed plans to increase their scrutiny of cryptocurrency exchanges and ICOs. In its corporate plan for 2018-2022, ASIC pinned the cryptocurrency sector as its main area of focus. According to Australian regulators, they “will continue to focus on monitoring threats of harm from emerging products (e.g. ICOs and cryptocurrencies), cyber resilience, the adequate management of technological solutions by firms and markets, and misconduct that is facilitated by or through digital and/ or cyber-based mechanism.”

South Korea calls for greater cooperation in global crypto regulation

During the 20th Integrated Financial Supervisors Conference (IFSC) held in Seoul, Financial Supervisory Service (FSS) governor, Yoon Suk-heun urged the need for international cooperation among the regulators for crypto and ICOs in order to prevent the risk of money laundering which could potentially rise with the emerging financial products.

The SEC suspends Bitcoin and Ether investment vehicles in Sweden

The U.S. Securities and Exchange Commission has suspended the trading of the Bitcoin Tracker One and Ether Tracker One ETNs, issued by Swedish firm XBT Provider AB. According to the SEC, Swedish ETN creates “confusion amongst market participants”, as they may be percieved as ETFs, which have not yet been approved yet the authorities.

Cryptocurrency Markets

Fake News around Goldman Sachs creates confusion on Crypto Markets

On Wednesday, Business Insider reported that Goldman Sachs had dropped plans to launch a cryptocurrency trading desk, which immediately resulted in the total market cap dropping by $12 billion in an hour. However the day after, at the TechChrunch Disrupt Conference in San Francisco, CFO of Goldman Sachs, Martin Chavez denied the recent news saying, “I never thought I would hear myself use this term but I really have to describe that as a fake news”. The price of Bitcoin lost more than 6%, the second largest digital asset Ethereum fell by 15%, and the whole market kept dropping further despite the clarification by Goldman’s CFO.

Ripio launches Crypto-Powered loans across Latin America

Argentina-based peer-to-peer credit network protocol, Ripio Network, has launched in the marketplace after its beta version has successfully facilitated more than 800 loans to its customers. The company raised $37 million last year, and it is now one of the few crypto projects which has actually delivered a functioning product, with 3,000 active lenders on the network already. The Ripio Network matches individual lenders and borrowers through ethereum smart contracts with an average loan size of $146. CEO of Ripio, Sebastian Serrano said, “ We have people from Asia funding people in South America, which is something you cannot do with any other app.”

Coinbase considers crypto ETF with help from BlackRock and launches GBP pairs

The leading firm in the crypto industry has reportedly opened conversations with $6 trillion Wall Street giant BlackRock to analyze Coinbase‘s potential in launching crypto ETF. Even though the overall situation with Bitcoin ETFs remains unclear, the experts believe that the joint forces of these two leading firms will turn be successful.

On Friday 9 AM BST, Coinbase officially launched new GBP trading pairs for Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic and Litecoin. According to the company’s blog post, all UK customers can now deposit GBP to their Coinbase accounts via domestic bank transfers, which makes crypto trading easier, faster and cheaper for UK customers.

Winklevoss twins win patent for crypto key and cold storage

The U.S. Patent and Trademark Office has published the document, showing that the founders of the Gemini Exchange, Tyler and Cameron Winklevoss, have won the patent for securely storing cryptocurrencies and other digital assets. Patented under the title “Systems and methods for storing digital math-based assets using secure portal” it aims to build a secure and isolated network of computers and suitable writing devices, which are able to generate digital asset keys, which would be further written onto an external memory device or physically written down on paper or even papyrus.

Robinhood eyes an IPO

The zero-fee exchange app, which offers stocks, options and cryptocurrency trading with no fees, is preparing to go public. Currently valued at $5.6 billion, the five year old fintech startup has raised altogether $539 million from top-notch investors like Sequoia, Google, Andreessen Horowitz and others. Robinhood currently supports trading of five cryptocurrencies and has more than 5 million active users.

Vitalik Buterin thinks Blockchain space won‘t see 1,000x growth again

In an interview with Bloomberg, the founder of Ethereum, Vitalik Buterin, expressed his opinion that the period of massive growth of cryptocurrencies is “getting close to hitting a dead end”. Buterin sees the space moving from “just people being interested”, to the stage of “real applications of real economic activity”, he further added, “If you talk to the average educated person at this point, they probably have heard of blockchain at least once. There isn’t an opportunity for yet another 1,000 times growth in anything in the space anymore.”

Dogecoin’s demo successfully released

Developers of cryptocurrency Dogecoin have successfully released the Dogethereum bridge demo which enables the flow of DOGE coins in and out of Ethereum. Users can now exchange their coins for any existing coins built on top of the Ethereum blockchain. Dogecoin is one of the oldest crypto coins, as it was first introduced in 2013 as a “joke coin” named by the internet dog meme. The founder of the coin, Jackson Palmer, doesn’t really see “any real value to either project”, and according to him, the Dogethereum “provides no usefulness or cost efficiency vs. something simpler like atomic swaps.” Nonetheless, despite Palmer’s skepticism, the coin has enjoyed a lot of hype over the past weeks, and since the end of August has spiked by almost 140%, helped by the Yahoo Finance app and Robinhood, which listed the Dogecoin together with the most prominent cryptocurrencies earlier this month.