Since the start of July 2017, ICOs have raised $19bn.

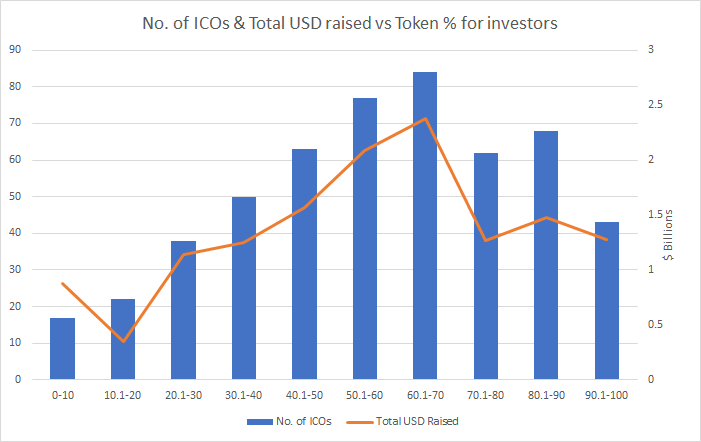

Projects looking to token offerings as a fund raising mechanism must evaluate trade-offs between allocating a greater proportion of tokens to investors and keeping hold of tokens to incentivize the development team.

Striking the correct balance between founder allocation and the quantity of tokens distributed to the public is crucial to the long-term prospects of the project, particularly in light of the price volatility of the crypto-assets raised in the token sale.

Teams concluding their ICOs at the tail-end of 2017, with Ethereum priced at over $1,300, have seen their projected runway cut by more than 60%. The volatility of the crypto funds raised by ICO compounds the natural uncertainty surrounding the development of early-stage startups.

One such project, the U network, ran out of its token supply as the number of its strategic partners continued to grow. Despite allocating only 40% of its tokens to the public, the U network team exhausted its supply of UUU tokens, leading to a planned token buyback. While token buybacks could have a positive effect on price and may be employed in the future as a a stabilizing mechanism during bear markets, it is worth noting that the token reserved for the U network team and advisers was significantly greater than the average.

ICO project founders have to contend with the dual risk of launching an early-stage startup and doing so in the volatile climate of the crypto markets.

Choosing a token allocation model involves a trade-off between maximizing proceeds of the token sale by issuing more tokens to the public, and retaining enough tokens to incentivize current and future stakeholders to grow the network.

Getting the allocation model right is crucial for teams looking to ensure the longevity of their project.

This facet of the ICO model is particularly important for projects launching during the current bear market, where there is greater scepticism towards new projects, and in a climate where investors are likely to be more reticent than the heady days of late 2017.