Based on data from Bitinfocharts.com

Based on data from Bitinfocharts.com

While the creation of blockchain technology allowed us to disrupt the way we transact with money, the uneven distribution of cryptocurrency is still an issue preventing Satoshi’s vision of a more inclusive financial system from being realized entirely.

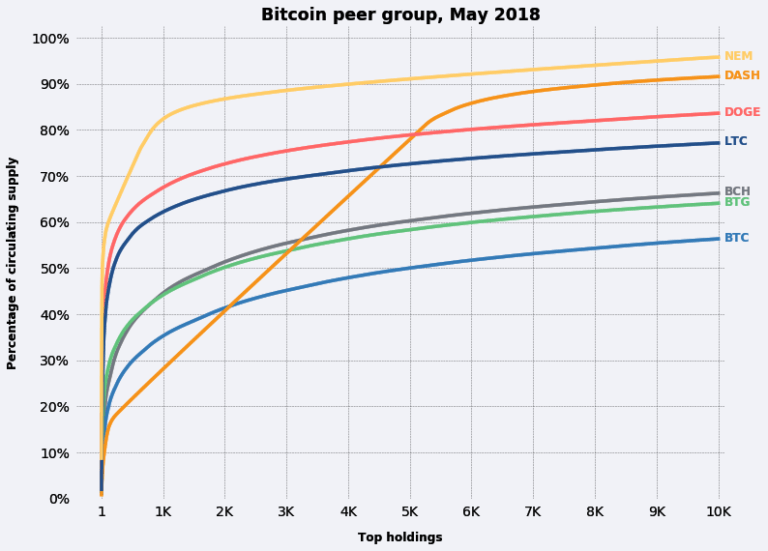

Newly minted Bitcoin is distributed exclusively to the miners securing the network, resulting in the top 10000 wallets controlling 55% of the float. With over 15 million wallets holding some measure of Bitcoin, that means that the top 0.07% control more than half the circulating supply.

The disparity between the balances held by crypto ‘whales’ and those belonging to the rest of the ecosystem can be found to a larger degree amongst projects that forked off Bitcoin. Litecoin, for example, sees the top 10,000 wallets holding 78% while the top 10000 addresses in the Bitcoin Cash and Bitcoin Gold hold 66% and 64% respectively.

However, the leading wallets do not represent private individuals, they belong to cryptocurrency exchanges and are used to fund operations. This suggests that investors leave a greater amount of their altcoin holdings on the exchanges, preferring to keep their BTC on private wallets.

DASH and NEM Masternodes

While the distribution inequality amongst Bitcoin and its many forks is not as equal as many want, the situation is worse amongst masternode coins such as Dash and NEM. A Dash masternode costs 1000 Dash, the equivalent of $338,000 according to CryptoCompare data, while an NEM masternode will set you back 3,000,000 NEM or $780,000.

The appeal of generating passive income for operating a masternode has seen 59% of Dash’s circulating supply locked up as masternodes. Absent solutions that allow average investors to pool together capital in an effort to set up a masternode, this uneven distribution of wealth amongst masternode coins is set to continue assuming the Dash protocol rewards masternodes with 45% of block rewards.

Based on data from CryptoCompare

Based on data from CryptoCompare

While in theory, locking up a large percentage of token supply in a masternode will reduce the token velocity thereby lowering price volatility, Dash has proven to be one of the more volatile privacy-focused tokens on the market today. The price of masternodes creates inflated buying and selling pressure as masternode operators enter and exit the market with their large holdings.