The advent of Blockchain technology has allowed us to represent and communicate digital scarcity.

Together with the introduction of smart contracts by the Ethereum project in 2014, we are now able to build a novel class of software products, known as decentralized applications, that function without a centralized server.

Allowing for the decentralized, permissionless and trustless storing and transfer of data means that we can vastly improve the cost, security and transparency of a whole host of applications.

Since the launch of Ethereum, an explosion of innovation has occurred in the ecosystem, leading to the launch of over 700 tokens on the Ethereum blockchain in 2017 alone.

Ethereum however, is currently facing scalability concerns which limit the throughput of the network to around 15 transactions per second. If one of the 1090 dApps currently built are to capture sizeable market share, Ethereum will have to solve its scaling problem.

CryptoKitties

Ethereum was created with the very serious purpose of revolutionizing the financial system with smart contract technology. The first dApp to go viral and capture the imagination of network participants was the fun, quirky digital collectible token known as CryptoKitties.

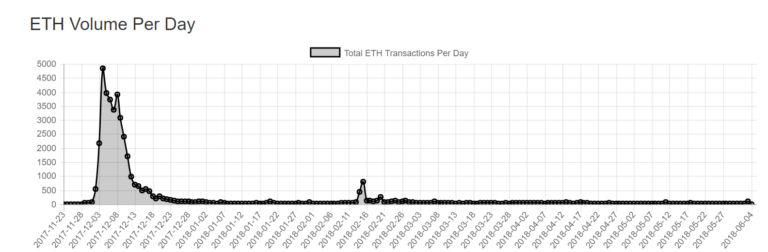

Cryptokitties is a blockchain game which lets players collect and breed digital cats. During the raging bull market of December 2017, Cryptokitties caught fire with a 4833 ETH (or more than $2million) daily volume of these novel tokens being traded at the height of the kitty mania. According to ETH gas station, CryptoKitties was responsible for 12% of Ethereum transactions at the time.

The subsequent drop-off in kitty trading volume suggests that these viral collectible fads will hit a ceiling due to Ethereum’s throughput limitations – resulting in a sharp decline of consumer interest.

Decentralized systems are still in their infancy, and many attempts to overcome the scalability hurdle to mass adoption are currently underway. Ethereum developers are working on a number of solutions, from a new Proof-of-Stake-based consensus algorithm to second -layer solutions such as sharding and plasma.

Competitors such as EOS, Qtum and Cardano are all tackling scalability in a different way as they look to capture market share from Ethereum – by providing an alternative smart contract platform for the development of decentralized applications.