Source: cryptofundresearch.com

Source: cryptofundresearch.com

As the pace of innovation in the blockchain space speeds up and the crypto asset class gradually penetrates the mainstream, we can expect to see a corresponding increase in the number of asset managers entering the space.

2017 saw the entry of 130 crypto funds into a market that counted a mere 89 funds beforehand, with 147 funds projected to be launched over the course of 2018.

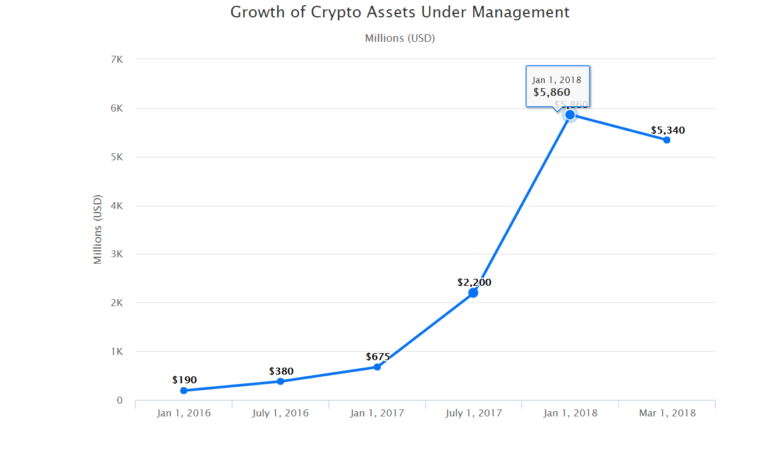

At the beginning of 2017, the 89 crypto funds controlled a collective $675m in assets under management – with the average fund worth $7.6m.

2017 was a boom year for the crypto space, with the value of assets under management controlled by the 219 crypto funds existing by the end of 2017 reaching $5.86bn. Appreciating cryptocurrency prices had a dual effect of both increasing the net worth of incumbent funds as well as drawing new players into the space. As markets fell from their Jan 2018 highs, the crypto fund industry saw a contraction.

Boom Still to Come

The 2800% growth of the crypto fund industry is impressive, but it there is a good case to be made that we are still in the development phase of this technological revolution.

This point really becomes apparent if we compare the relative size of the crypto fund industry to the total hedge fund industry. Currently, hedge funds control wealth to the tune of $3trn – making the industry worth over 500 times the crypto space.

We can expect to see this gap closed as a result of two primary factors: increased regulatory clarity and the advent of security tokens.

The uncertainty surrounding regulation is keeping many of the more conservative asset managers away from the space. As regulatory authorities slowly begin to clarify their positions, these fund managers will start to dip their toes into the crypto asset pool.

Furthermore, enhanced regulatory clarity will also lead to the growth of security tokens. Security tokens tokenize the ownership of real-world assets such as company shares and real-estate, allowing them to be traded on the blockchain.

Indeed, while the last two years have seen crypto funds post incredible gains, the space is still in its infancy. As the fog of regulation begins to clear and security tokens come online, we can expect to see the crypto fund industry reach even greater heights.