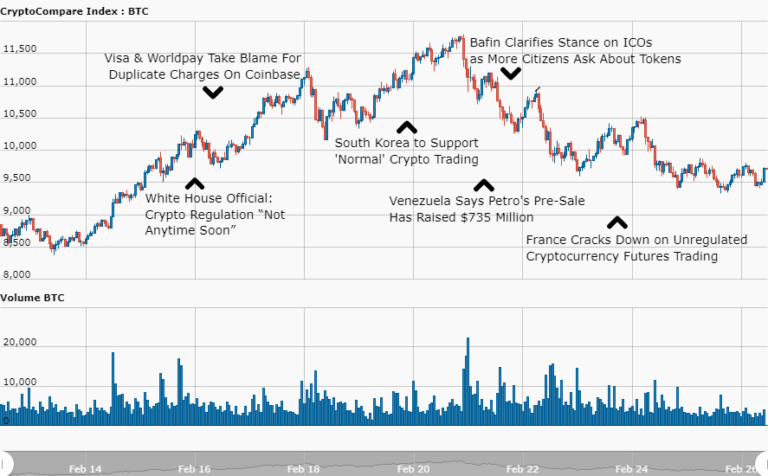

Crypto Regulation “Not Anytime Soon”

A White House official said last week that legislation around cryptocurrencies is unlikely to materialize anytime soon. Speaking at the Munich Security Conference, White House cybersecurity coordinator and special assistant to the president, Rob Royce, offered the assessment amidst a recent flurry of discussion on cryptocurrency regulation. Which is playing out in the form of Senate hearings, enforcement actions and public op-eds. The White House cybersecurity coordinator said:

“I think we're still absolutely studying and understanding what the good ideas and bad ideas in that space are. So I don't think [cryptocurrency regulation] it's close.”

Visa & Worldpay Take Blame

Visa and payment processing company Worldpay issued a joint statement on the Coinbase blog last week, taking responsibility for charging Coinbase customers multiple times for the same transaction. Before admitting fault in the statement published by Coinbase, Visa had at first blamed Coinbase, telling the Financial Times on Feb. 16 that it had not made any systems changes that would result in the duplicate transactions cardholders are reporting. However, the latest statement from Visa and Worldpay reads:

“Worldpay and Coinbase have been working with Visa and Visa issuing banks to ensure that duplicate transactions have been reversed and appropriate credits have been posted to cardholder accounts”

California Bill Would Legally Recognize Blockchain Data

Last week, a California lawmaker named Ian Calderon has introduced a bill that, if passed, would update the state’s electronic records laws to include blockchain signatures and smart contracts. Assembly Bill 2658 aims to expand on the definition of electronic records and signatures to include those on the blockchain, recognizing the potential for legal immutability afforded by in distributed ledger technology which can be far superior to legacy methods in many ways. The bill reads:

“A record that is secured through blockchain technology is an electronic record.”

Venezuela Says Petro’s Pre-Sale Has Raised $735 Million

Last week, Venezuela has announced that the pre-sale of its oil-backed cryptocurrency, the Petro, has attracted $735 million on the first day. The government has also published a buyer’s manual and confirmed that buyers can use hard currencies and cryptocurrencies, but not bolivars. The Superintendent of Cryptocurrencies, Carlos Vargas, stated:

“The presale and the Initial Coin Offer will be made in hard currencies and cryptocurrencies, but not Bolivars. Our responsibility is to put the Petro in the best hands and then a secondary market will appear.”

South Korea to Support ‘Normal’ Crypto Trading

South Korea appears to be softening its stance on cryptocurrency trading. According to Yonhap News, Choe Heung-sik, governor of the Financial Supervisory Service, has said last week that the government “will support cryptocurrency trading if normal transactions are made”. According to BusinessKorea, a government official involved with a virtual currency task force said:

“We are positively considering the adoption of an exchange approval system as the additional regulation on cryptocurrencies. We are most likely benchmark the model of the State of New York that gives a selective permission [for exchange operations].”

Bafin Clarifies Stance on ICOs

Last week, Germany’s financial regulator Bafin has clarified its position on Initial Coin Offerings. Bafin admitted it was receiving many inquiries about the status of tokens and cryptocurrencies distributed to investors through ICOs. The federal agency advised interested parties to refer to regulations applicable to traditional financial instruments and comply with current requirements.

In an advisory letter, Bafin provides some basic definitions of ICOs and related terms. The regulator’s objective is to educate the public about cryptocurrencies and tokens, which are typically generated using distributed ledger or blockchain technology. With a particular focus on ICOs, that are used to raise funds for startup projects.

Ripple Is Releasing Two New White Papers

Announced last week, San Francisco-based startup Ripple is releasing two new white papers for peer review – one describing XRP’s consensus algorithm in a more formal way and the other outlining a way to improve the diversity of connections of each node, the software users run to relay and verify transactions on the network.

In an interview, Ripple CTO Stefan Thomas sought to stress how the papers open up the possibility of further building a network effect around the tech. Thomas stated:

“This is the first time we're releasing peer-reviewed academic papers. Obviously, it opens the door for future research. After this, I expect you'll hear much more about us interacting with academia.”

Tesla ‘Cryptojacked’

Tesla, the electric car manufacturer based in Palo Alto, California, is the latest corporation to fall victim to ‘cryptojacking’, according to a research from cybersecurity firm RedLock.

The researchers found that hackers had infiltrated Tesla’s Kubernetes console (a system for containerized apps that was originally designed by Google) which was not password protected. The hackers were mining for cryptocurrency from within one of Tesla’s Kubernetes pods.

The team noted some sophisticated evasion measures that were employed in this attack. Unlike other crypto mining incidents, the hackers did not use a well known public mining pool in this attack. Instead, they installed mining pool software and configured the malicious script to connect to an unlisted or semi-public endpoint. This makes it difficult for standard IP/domain-based threat intelligence feeds to detect the malicious activity.

Venezuela to Accept Cryptocurrency

Venezuela’s president Nicolas Maduro has ordered the country’s consular services, as well as several other services and gas stations, to accept any cryptocurrency including the nation’s own currency, the Petro. This announcement was broadcasted nationwide from the Miraflores Palace and also reported on the website of the Superintendency of Cryptocurrencies. The president said:

“I order the payment of consular services in all embassies and consulates of the Bolivarian Republic of Venezuela in the world, and all consular services in the country, in the Petro currency or in any cryptocurrency.”

France Cracks Down on Cryptocurrency Futures

In a statement released last week, the Autorite des Marches Financiers (AMF) said that it had observed a variety of online trading platforms launch cryptocurrency-based derivatives such as binary options, contracts for differences (CFDs), and Forex contracts. The agency, which attributed this development to the “recent cryptocurrency boom,” said that it had concluded that cash-settled cryptocurrency contracts qualified as derivatives, making them subject to AMF oversight. The agency stated:

“The AMF concludes that a cash-settled cryptocurrency contract may qualify as a derivative, irrespective of the legal qualification of a cryptocurrency. As a result, online platforms which offer cryptocurrency derivatives fall within the scope of MiFID 2 and must, therefore, comply with the authorisation, conduct of business rules, and the EMIR trade reporting obligation to a trade repository.”