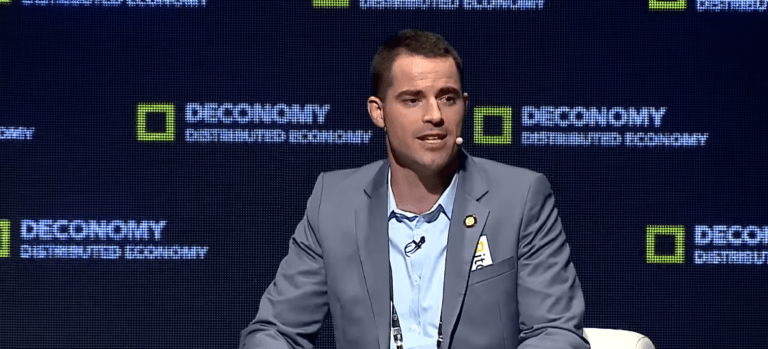

Roger Ver, an early investor in Bitcoin and a prominent figure in the cryptocurrency world, has been indicted on charges of mail fraud, tax evasion, and filing false tax returns. Ver, who gained the nickname “Bitcoin Jesus” for his enthusiastic promotion of the digital currency, was arrested in Spain last weekend based on the U.S. criminal charges. The United States government is now seeking his extradition to stand trial.

According to the indictment, Ver, formerly a resident of Santa Clara, California, owned two companies, MemoryDealers.com Inc. and Agilestar.com Inc., which specialized in selling computer and networking equipment. In 2011, Ver allegedly began acquiring bitcoins for himself and his companies, amassing a significant amount of the cryptocurrency over time.

The charges against Ver stem from his alleged actions surrounding his expatriation in 2014. On February 4 of that year, Ver reportedly obtained citizenship in St. Kitts and Nevis and subsequently renounced his U.S. citizenship. As a result of this process, U.S. law required Ver to file tax returns reporting capital gains from the constructive sale of his worldwide assets, including his Bitcoin holdings, and to pay an “exit tax” on those gains.

At the time of his expatriation, Ver and his companies allegedly owned approximately 131,000 bitcoins, with MemoryDealers and Agilestar holding around 73,000 of those coins. The bitcoins were trading on several large exchanges at approximately $871 each.

The indictment alleges that Ver hired a law firm to assist with his expatriation and prepare the necessary tax returns, as well as an appraiser to value his two companies. However, Ver allegedly provided false or misleading information to both the law firm and the appraiser, concealing the true number of bitcoins he and his companies owned. Consequently, the law firm allegedly prepared and filed false tax returns that substantially undervalued MemoryDealers, Agilestar, and their Bitcoin holdings, while also failing to report Ver’s personal bitcoin ownership.

By June 2017, Ver’s companies still held approximately 70,000 bitcoins. Around that time, Ver allegedly took possession of those bitcoins, and in November 2017, according to the U.S. Department of Justice (DOJ), he sold tens of thousands of them in cryptocurrency exchanges for roughly $240 million in cash.

Per the DOJ’s press release, despite no longer being a U.S. citizen, Ver was still legally obligated to report certain distributions, such as dividends from his U.S.-based corporations, MemoryDealers and Agilestar, to the IRS and pay the corresponding taxes. However, the indictment claims that Ver concealed from his accountant the fact that he had received and sold the companies’ bitcoins in 2017. As a result, the DOJ claims, his individual income tax return for that year did not report any gain or pay any tax related to the distribution of the bitcoins.

The total alleged loss to the IRS resulting from Ver’s actions is estimated to be at least $48 million.

The announcement of the indictment was made by Acting Deputy Assistant Attorney General Stuart M. Goldberg of the Justice Department’s Tax Division and U.S. Attorney Martin Estrada for the Central District of California. The case is being investigated by the IRS Criminal Investigation’s cybercrimes unit, with prosecution being handled by Assistant Chief Matthew J. Kluge and Trial Attorney Peter J. Anthony of the Justice Department’s Tax Division, along with Assistant U.S. Attorney James. C. Hughes for the Central District of California.

It is important to note that an indictment is merely an allegation, and all defendants are presumed innocent until proven guilty beyond a reasonable doubt in a court of law. The case against Roger Ver is ongoing, and the outcome will be determined through the legal process.